Yesterday I initiated a trading position in Hasbro. I'm looking for 15% to 30% upside over the next 12 to 18 months.

Hasbro is a company that I've been tracking for years and invested in on and off. My core love for the company is based on its sitting in a very attractive place in the games and gaming market.

Hasbro owns IP for some of the world's best franchises, including Magic the Gathering, Dungeons & Dragons, Monopoly, Nerf and Peppa Pig. They're also the exclusive toy manufacturer for Disney's Marvel and Star Wars films. This position in the games market and in the toy market puts them in a unique position to monetize IP both by direct manufacture and sale of toys and games and by franchising that IP to other game creators.

What I like about a lot of their IP is that they are relevant not just for kids, but for adults. Magic the Gathering and Dungeons & Dragons serve an ever-growing audience of adults, gaming fathers and sons, getting the whole family involved. This segment has a much higher propensity to spend, and the buyer is also the user, which is always an easier sell.

Hasbro has been undergoing a few difficult years ever since COVID and the closure of Toys R Us, one of their biggest retail partners, as well as a lackluster strategic execution of 'becoming the next Disney' and pivoting into filmmaking. Current management is executing a turnaround in the business to improve the health of their consumer products goods segment by licensing a lot of underperforming segments. This has hurt top line growth but improved the bottom line through improved margins and lower inventories. They've also doubled down on licensing game IP to digital gaming. Two recent examples of success in this from the past two years are Baldur's Gate and Monopoly Go, both successfully licensed to third-party game developers that have dramatically boosted Hasbro's bottom line.

That's all background and macro on the longer-term time horizon for Hasbro. What makes this a good trade?

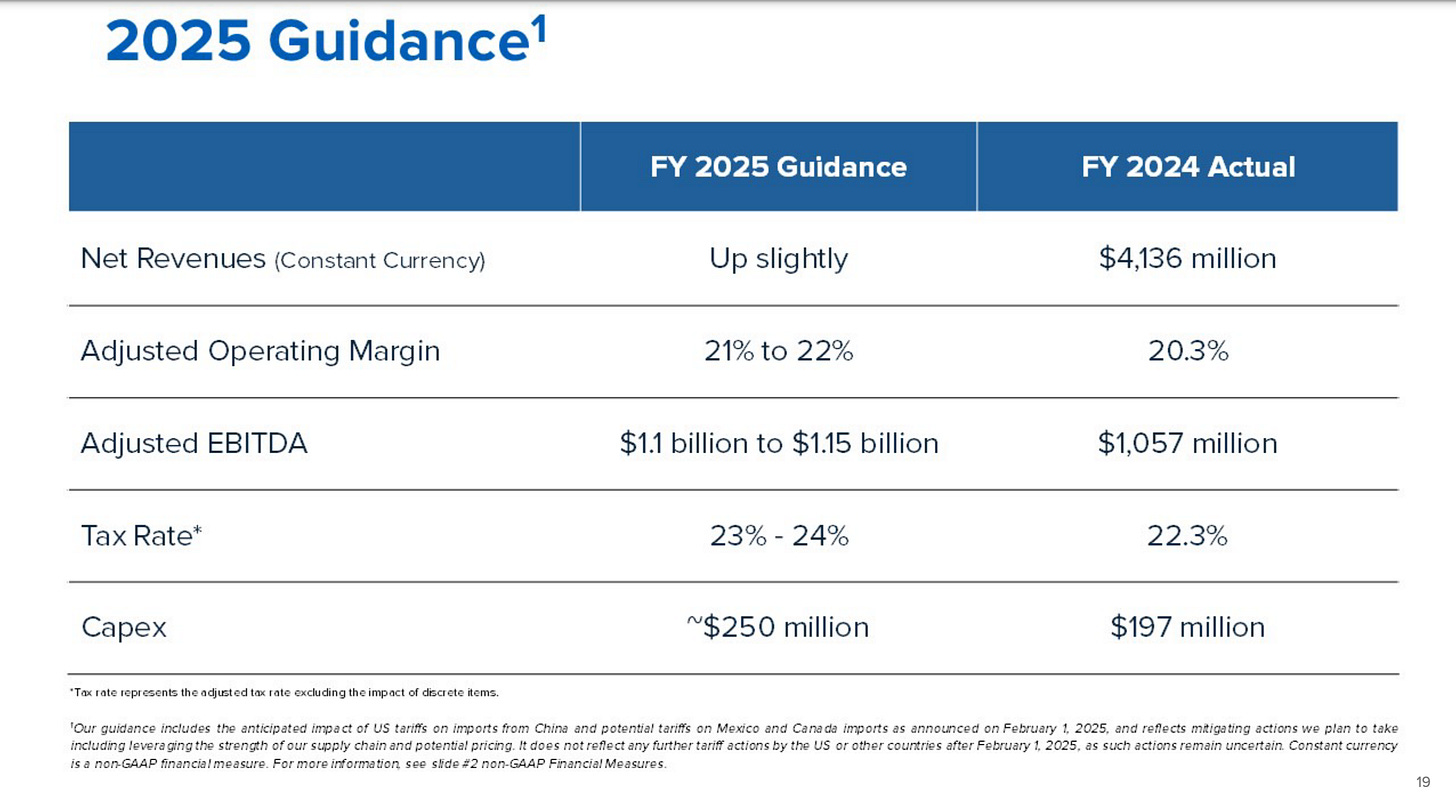

Despite executing on this turnaround well and pivoting the company towards growing profitability and reducing debt, the stock has been languishing. They're not getting the benefit of the doubt from the market for this turnaround, which includes arriving at positive revenue growth (finally) next year. This is being reflected in a historically high 5% dividend yield. Hitting these targets within the next 12 months will cause a rerating in the stock to a more historical norm of a 3-4% dividend yield, implying a stock price between $70 - $80, providing 16% - 33% upside, not including the dividend.

Over the next year and a half, there are several positive catalysts for the company, including some Marvel movies that are going to come out and always dramatically benefit Hasbro, specifically Captain America, which was released in February 2025, and a new Spider-Man, and Avengers installment in 2026 with yet another Avengers in 2027. It's been a couple of years since a full 'Avengers' movie has been released, and this should boost Hasbro's failing toy unit, which would also increase margins and overall pivot the company into a much greater position. There's also positive upside from MtG.

However, despite these positive catalysts, management is only guiding for low revenue upside - Despite the interesting story and positive catalysts, it's not translating into faster top-line growth. That's because there are headwinds as well, which are lapping Monopoly Go and Baldur's Gate, and the aforementioned tougher Magic the Gathering comparison, as well as struggling consumer products categories like Nerf. I'll take management as a better forecaster of the business than me, and yet I think the stock is not reflecting the turn around being executed here.

Should management succeed at meeting their relatively low guidance bar, I think the stock will rerate. Having pulled back 15% from its post-earnings pop, together with the rest of the market, and a 5% yield, this makes Hasbro an interesting hold for the next 12 months.

Some concerns on the stock are, of course, tariffs and decreasing consumer sentiment, which could impact the company, which is why I'll manage the risk here with a relative tight stop, providing me a 5 down vs 15 up risk reward.

I remember investing in Hasbro in 2021. It was one of my biggest investment mistakes.

I did it by following a Coattail Investing approach with Alta Fox Capital’s activist campaign. I conducted my due diligence, but I didn’t account for the management’s power to block those changes, which ultimately allowed them to defeat Alta Fox.

It’s a solid company, and its Dungeons & Dragons and Magic assets hold significant value, but without catalysts to unlock that potential, I find it hard to invest in it.

I no longer follow the stock, so I’d love to hear your thoughts.