Deep Dive: Spotify & music's long term value

10,000 words, 15 charts, 4 price targets: all you need to understand this company

My portfolio is built around long-duration growth companies. This deep dive about Spotify aims to answer that question: Is Spotify part of this group, and what value should we be willing to pay if so?

My biases up front: I've owned Spotify since 2021, doubled and tripled down in 2022 and currently Spotify is my largest long position, constitutes 40% of my portfolio and is up 4x. Naturally, I am very bullish on the company. However, I can't afford to approach this analysis blindly; if I'm wrong, my portfolio will be hit hard.

So I will go through this analysis with eyes wide open and take you with me as I examine:

Spotify's moat & strategic position

Improving business metrics

Future growth and the durability of that long-term revenue

Valuation and whether this company is worth investing in

You might have heard that Spotify is at the mercy of record labels, that they'll never make money, that they're overvalued, that they have no control of their future, that they're just an app for commoditized music or that they're competing with the magnificent seven and don't stand a chance. My thesis takes the opposite of all that: Spotify is a unique stock and the company with a powerful moat and long duration growth. Spotify benefits from four of Hamilton Helmer's seven powers: network effects, economies of scale, switching costs and a cornered resource. This makes it a very long-duration cash flow generator with growth potential.

Spotify is not only an excellent product, as evidenced by its massive happy user base, but also an excellent business that has reached its inflection point.

I'll assume you know Spotify. Their business model is simple: They are a two sided marketplace. On one hand they license content (music, podcasts, audiobooks and educational courses) from rights holders and on the other end they acquire customers who pay for listening to the content. Monetization occurs with two tiers: ad supported and premium. Ad supported users listen for free and are monetized via ads. Premium users pay a monthly subscription through a variety of different offerings: family, duo, student or single plan.

Moats & strategic position

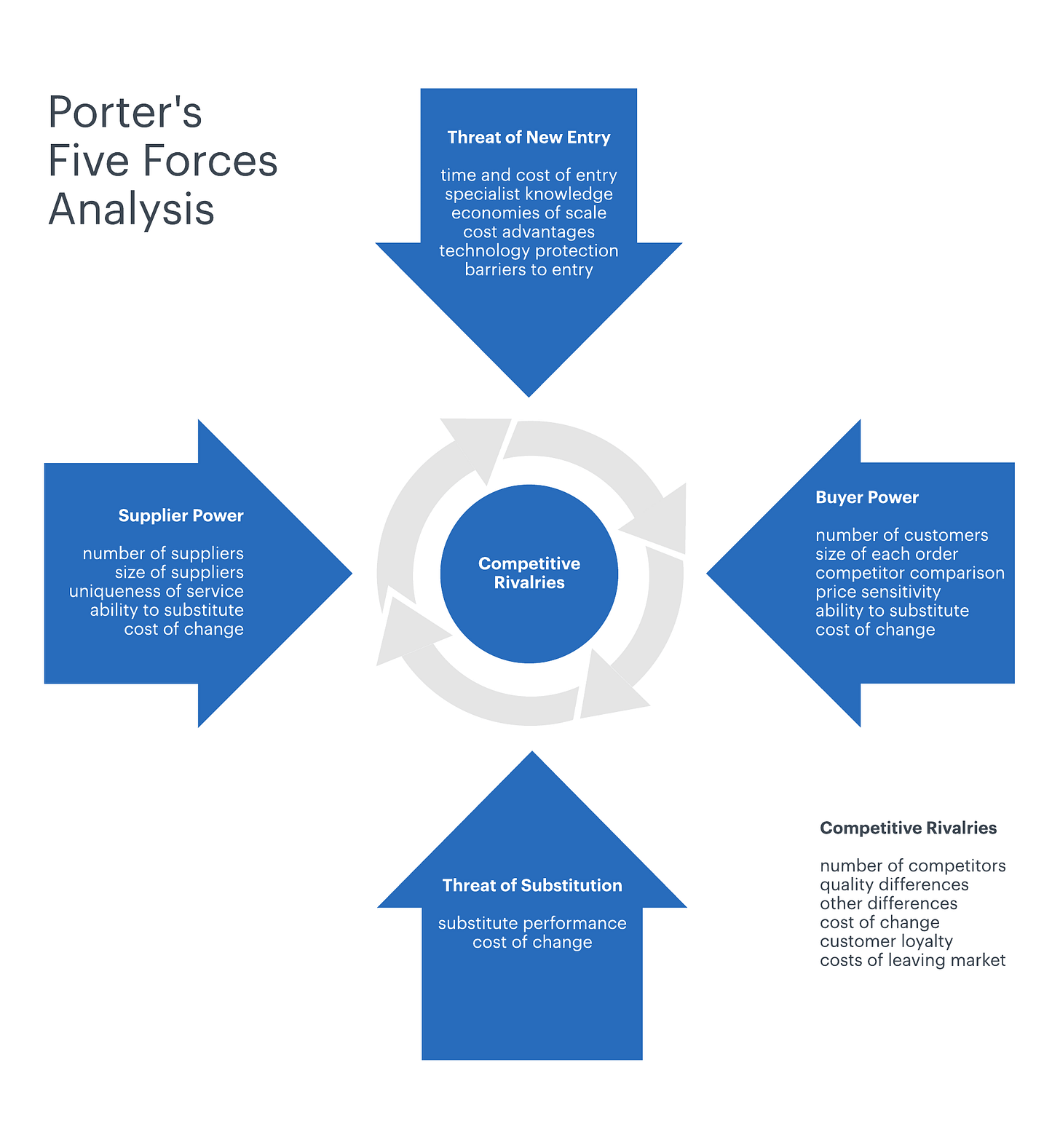

Spotify has powerful moats that drive the financial upside of this business. I'll be using three strategic frameworks to evaluate Spotify's position and moat:

Hamilton Helmer's '7 powers': The seven powers he references are: brand, process power, network effects, cornered resource, scale economies counter positioning and switching costs. Spotify has 3 of the seven, and in additionally has one more not mentioned in his framework:

Ben Thompsons Aggregation Theory: Spotify is an audio content aggregator.

Porters five forces: Spotify is well positioned vs their internal competition and vs other external forces.

Together, these amount to a powerful moat for the business. Let's explore each of these in order.

Network effects

Although we often think of music as a 'single player mode' business model, it is much more social than one might expect. The shared aspects of music sharing such as collaborating on playlists, sharing music recommendations, a joint 'jam' session and sharing music within the family all contribute to a network effect business, where the value per user grows as more of their relevant social graph join the network. Additionally, there's a viral aspect to it. I benefit from having my kids on Spotify so I invite them. You benefit from sharing collaborating with your fellow student on a 'focus playlist'.

While this isn't a Facebook or Whatsapp level network effect, it's definitely more limited in power, it's definitely there. And it shows up in the numbers: despite massive user growth, customer acquisition costs have dropped, speaking to a greater efficiency that comes from achieving these kinds of network effects.

Scale economies

While Spotify doesn't 'produce' anything in the classical sense of manufacturing, their entire business is built around scale. From their contracts with labels that benefit from increased MAUs and premium subscribers, through their infrastructure costs and payment processing all the way to their Spotify Wrapped campaigns.

Here are two examples of this from Spotify's Q4 2024:

Wrapped is a massive cultural moment for Spotify, but it's also become a significant driver of our business. This year, over 245 million users engaged with Wrapped surpassing 2023's record within the first 7 days of the campaign. And importantly, we saw impressive engagement in key growth markets like Brazil and Indonesia. Every year, it's just wild to see how deeply our users care about their own personalized Wrapped experience. And because it's become such a phenomenon, it also means that there's a ton of visibility.

That's massive scale driving lower customer acquisition costs that even well established players like Apple and Google will have trouble competing with. But scale impacts the business as well and CEO, Daniel Ek, puts it:

And if you want to simplify it to the very core, everything for Spotify is, if we get meaningful scale, our margins and our profits goes from there.

I'll explore the benefits of scale vis a vis the record labels below.

Switching costs

Once you go Spotify, you rarely go back. Once you use a music streaming app in general, it is very very hard to leave. Playlists, shared songs, recommendation algorithms and music history all make it a very sticky experience. Layer on top of that where you listen to podcasts and now audiobooks, and you've got something even stickier. Anecdotally, I've asked 20 people I know if they've cancelled their Spotify subscription. Only one had. Over the past two years Spotify's management has consistently pointed out that time spent on the app has increased and despite price increases retention has only improved. All of this speaks to very powerful switching costs.

If you, for instance, take a look at the monthly time spent on Spotify, it's one of the highest compared to any of the top entertainment platforms out there.

Cornered resource

While music is, in many ways, a commodity, Spotify, the stock is not. There are only two real pure music plays out there in the public markets: Spotify and UMG. If you want to invest in the theme of the growing music over time, one of these is your bet. Spotify is the only one listed on US exchanges, making it a default choice.

Strategic market position: Aggregation and Porters five forces

Spotify's value chain is straightforward but complex. They operate in four distinct audio categories: Music, podcasts, audiobooks and educational content. In each they license audio rights and serve that audio to end users:

Music

Spotify licenses their content from record labels and public rights organizations. This value chain is unique in that four large players, Universal Music Group (UMG), Sony Music and Warner Music Group and Merlin own the majority of streamed music. In 2024 71% of all streams on Spotify were owned by these three (importantly this is down from 84% a few years ago). This makes it a tough operating environment in as much that Spotify must have all three on board or their product will lack the full music catalog that consumers are expecting. Historically, this has meant that the big three labels can set the price for licensing music in the industry. For many years, this was apparent in Spotify's gross margins that were locked below 25%. For Every dollar that came in 75c had to be paid out to the music rights holders, leaving only 25% for Spotify.

While this may sound like a dynamic that leaves Spotify in the lurch, the truth is that this is much more of a win-win dynamic than most people think. Spotify and other streaming platforms have been the key drivers in the entire music industry's growth over the past decade. If an artist's music isn't on Spotify, they don't benefit from that growth. It's not so simple for a label to simply remove their music from Spotify - they'd need to explain to their artists why their earnings just dropped massively.

This is a symbiotic relationship between streaming applications and the big three record labels. This relationship has shifted even more in Spotify's favor as it has become the dominant streaming platform. If Taylor Swift wants to go on tour in South America and wants fans to hear her new songs before she performs them live, guess where they'll be heard? That's right, on Spotify. This means that labels are now relying more than ever on Spotify for music discovery. It really is a symbiotic relationship. As Ek puts it:

"So first and foremost, I think one of the most common misconception that I quite often hear from analysts is that they believe that there is a win-lose dynamic between us and the labels. Ever since starting this company 18 years ago, that's not how we've looked at this. We always look at this as a win-win dynamic.

And from Warner's Q2 2024 call where Spotify is recognized as a "parties that are tied at the hip and partners for the future." And Universal Music Groups Capital Markets day where management calls out Digital Streaming Providers (DSP):

what we've been able to do with the DSPs and with the partners, Don't underestimate that we call them partners. They are partners. The amount of work, the amount of strategy and on my earnings calls, we talk about win win situations. Don't underestimate what I'm trying to say.

They really are genuinely win win.

This win-win relationship means that Spotify and the big three are incentivized to work together to create new business models for the music industry that can grow revenue.

Podcasts

Unlike music, podcasts have no big three, and there is nothing like the concentration in supply that exists in music. It is an industry categorized by a very very long tail of individual publishers. The lack of a dominant entity to establish uniform advertising standards, coupled with the widespread use of RSS protocol, has traditionally presented challenges in generating revenue from this medium. Additionally, there's no moat around the content itself since can create a podcast player that reads publicly available RSS.

Ben Thompson's Stratechery made the case that Spotify can be the aggregator for podcasts 5 years ago, way back in 2019. It's been playing out slowly but surely as first Spotify ensured that their app was the go-to destination for podcast listening by both focusing on it from a user experience and purchasing exclusive content - the Joe Rogan show, The Ringer and Gimlet were all acquisitions/exclusive licenses that Spotify made during 2019-2020 to make Spotify the go to for podcasts.

Audiobooks + Education

This category is in the middle between the centrally controlled music and the immensely long tail, undifferentiated open playground of podcasts. Books have a long tail of titles, but the most popular titles still drive a majority of the industry's profits. The book market has five large publishers but a large group of mid sized ones as well, making it a more fragmented industry. In education while there is a never ending tail of content, most topics can be covered by ~500 titles and courses. Both of these industries could use an aggregator who can bundle the offering and bring users to the excellent content that exists but isn't consumed enough. This is one of the reasons that Audible, Spotify's main audiobook competitor has bundled The Great Courses.

Spotify’s position at the center of audio content consumption is a natural fit for aggregation. Audio, unlike video or text, is consumed while commuting, working out, doing chores or just as background music. The 'job to be done' is similar across the medium. There's no real reason that a user would want a dedicated app for each different form of content. This makes an all-in-one solution compelling. More importantly, the different content types—music, podcasts, audiobooks, and courses—are complementary: someone listening to a finance podcast is likely interested in an investing course or an audiobook on economic history. This creates a powerful value proposition for users and a richer dataset for advertisers, increasing the relevance of ads and boosting ARPU.

The real power of Spotify’s model comes from aggregation theory. The more content Spotify adds, the more time users spend on the platform. The more time users spend, the more incentive content creators have to be there. The more content creators join, the stronger Spotify’s position becomes. This is the aggregation flywheel: Spotify doesn’t need to create content itself—it just needs to be the destination. Over time, this dynamic strengthens Spotify’s market power, as both users and creators become increasingly dependent on its ecosystem. This helps them set more favorable terms vis a vis both the supply and demand side of their platform.

However, there is a ceiling to this power. Unlike Google or Facebook—whose aggregation models are built on proprietary data and network effects—Spotify does not own or fundamentally transform the content it distributes. Google controls search, forcing websites to optimize for its algorithm. Facebook owns the social graph, making its ad platform indispensable. Spotify, on the other hand, is distributing content that exists elsewhere, whether that’s Apple Podcasts, YouTube, or Audible. They can always be unbundled. This limits its ability to extract value: content creators have alternatives, and users can switch. Spotify is an aggregator, but not an unassailable one.

Porter’s Five Forces

Another strategic framework I like is Porter's five forces. Based on the above analysis we can see:

Supplier power: Spotify is well positioned vs suppliers, and that their entry into audio content aggregation has only helped here. The same is not true for all of their pure music streaming competitors, who are more reliant only on the big three music labels.

Threat of new entry: while creating a new music streaming app is relatively 'simple', acquiring customers, licenses and scale are no easy lift at all. This is why we haven't seen any major new competition in the space over the past decade. It's stayed roughly the same between Spotify, Apple Music, Amazon Music, YouTube Premium, Deezer, Soundcloud and Pandora.

Buyer Power: This is a large market with lots of consumers and a varying 'willingness to spend'.

Threat of Substitution: There's limited threat of substitution. While audio content can be substituted for each other, there is a limit. For example on a drive to work I might be happy listening to a podcast, music or an audiobook and relatively agnostic between the three, but when I'm home with my kids I only want to play music from the speakers. As Spotify enters all of the substitution categories it increases it's market power.

The analysis via Porter's framework shows that being a pure music streaming application has some issues - their are substitutes, the suppliers have more power and a commoditized product has less pricing power. On the other hand, aggregating audio content ameliorates many of these issues: supplier relationships become more favorable, substitution becomes less of a threat and pricing power increases as value to customers increases. That is the exact play Spotify has been executing on.

Judging competition in the space has always been tricky. Spotify's main competitors are Apple, Amazon and YouTube, who all offer music services but don't reveal their numbers. On the one hand all of the competition benefits from offering bundles with their powerful platforms (Apple devices, Amazon Prime and YouTube). They all have cash to spare and distribution built in. On the other hand, they all suffer from lack of focus on the audio market and strategic weakness. Apple music is only compelling on Apple devices. Amazon music is an afterthought of Amazon Prime and YouTube is all about video. Of the three, YouTube is without a doubt the main competitor as they're the only one who is bundling audio content into one and a global, cross platform play. On YouTube you can find music, podcasts, courses and basically anything else anywhere in the world. But competition in the space isn't simple because of the high switching costs. While competitive fears have been around Spotify since their IPO, they have consistently beaten out the competition with increased focus and execution.

Summarizing Spotify's Moat

Spotify has built a durable moat through network effects, scale economies, switching costs, and content aggregation. Network effect driven social features drive adoption, scale economies lowers costs and improves margins, and personalized music and audio experiences make switching difficult. By aggregating music, podcasts, and audiobooks, Spotify becomes a content aggregator, maximizes user engagement and strengthens its market position vs its supply and demand.

All of this matters because it makes the case for very, very durable company revenue for years to come, which becomes meaningful when we'll start figuring out how much an investor is willing to pay for those future revenues.

Spotify's business

Let's run through the current business, gross margins and operational efficiency. After we have a solid understanding of what the status is currently and recent trends, we'll shift to forecasting the future.

Revenue at scale

The first thing to appreciate about Spotify's business is just how massive it's become:

675 million MAUs and 263 million Premium Subscribers across 184 countries

100 million music tracks, 6.5 million podcast titles and in select markets, over 350,000 audiobooks are available for à la carte purchase. eEligible Premium Subscribers receive a specified number of hours of access a month to a subscriber catalog containing more than 200,000 audiobooks.

Europe is the largest region with 181 million MAUs, accounting for 27% of total MAUs. North America accounts for 17% of MAUs. Latin America, with 22% of our MAUs, and rest of the world, with 34% of MAUs are the two fastest growing regions.

This scale has driven the revenue growth, which is primarily the Premium Subscribers segment, which Spotify has been able to grow reliably for years.

Premium subscriber growth is beena factor of the top of funnel, ad supported MAU, conversion. Over the past few years growth has decelerated as the company has scaled and reached a massive 675 million MAUs. Additionally growth has migrated from established markets, like Europe and North America to Latin America and RoW. This ability to convert Ad supported MAUs into Premium MAUs is a key driver for the business.

The percentage of premium subscribers of total MAUs has come down from 46% of total MAUs to 39% in 2024. However, total MAUs have tripled during the same period from 207 million to 675 million. That's a very impressive tradeoff and speaks very well of Spotify's conversion rate from free to premium.

Essentially this means that despite growing the top of the funnel 300%, the target market of Spotify's quality users, as measured by the premium/ad supported ratio, has diminished only 8% (1.06% per year or 1.6% per 100 million users). Importantly it's been a linear progression - the rate of change hasn't increased as Spotify reached greater scale or over the past two years as they've grown materially in emerging markets. This is important. It shows that we can anticipate with a decent amount of certainty that going forward, as Spotify grows to one billion users, this rate of change should stay give or take the same.

Monetization and go to market for Spotify is quite varied and definitely more dedicated than their competitors. They offer a variety of payment options, plans and customer acquisition channels. From their 2024 annual filing:

On go to market:

The Subscription Offerings are primarily sold directly to end users. The Premium Service is also sold through partners who are generally telecommunications companies that bundle the subscription with their own services or collect payment for the stand-alone subscriptions from their end customers

On premium monetization:

We offer a variety of subscription pricing plans for our Premium Service and Basic plan, including our Standard Plan, Family Plan, Duo Plan, and Student Plan, among others, to appeal to users with different lifestyles and across various demographics and age groups. Our pricing varies by plan and is adapted to each local market to align with consumer purchasing power, general cost levels, and willingness to pay for an audio service.... In addition, as we have entered into new markets where recurring subscription services are less common, we have expanded our subscription products to include prepaid options and durations other than monthly (both longer and shorter durations), as well as expanded payment options

On Ad Supported subscribers:

To date primarily been sold to ad agencies on a bespoke basis: "These advertising arrangements are typically sold on a cost-per-thousand impressions (“CPM”) basis and are evidenced by contracts that specify the terms of the arrangement such as the type of advertising product, pricing, insertion dates, and number of impressions in a stated period (“Insertion Order”)". As ad slots increase due to more time spent on the platform this inventory rises: Price per ad * ad slots = ASR (Ad supported revenue).

Now also entering programmatic advertising via Spotify Audience Network (SPAN).

All of these different go to market initiatives have helped fuel MAU growth over the years, as Spotify has something for almost every cohort of users (one important cohort has always been underserved...spoiler alert!). This is very different from competitors. For example Apple Music is non existent on Android and Amazon Music is very small outside the US. YouTube Premium doesn't offer a Duo plan.

Gross Margins

For years Spotify has been plagued by a gross margin stuck at 25%. This has caused many analysts to doubt the company's ability to control its own destiny and has given a lot of credence to the narrative that Spotify is at the mercy of labels. That 25% margin was set because of the music royalties that Spotify pays the labels.

When Spotify listed its shares in 2018 it was following a few years of dramatically improved gross margins. Yet in the following 5 years they plateaued. Over the past two years we've seen an explosion in gross margins - so what's the story?

Spotify's cost of revenue is made up of a few items: music royalties, podcast and audiobook licensing costs, payment and infrastructure costs and label discounts. Simply for every dollar Spotify brings in, if it's due to music, they have to pay out a royalty rate to the music rights holder and pay for servers and payment processing. If it's a podcast or audiobook they have to pay the podcast owner for serving the ad or the audiobook licensor.

The biggest item here has always been the music royalties. What's important to realize about the contract between Spotify and the music labels is that it's not a fixed cost contract. Rather there are incentives built in so that as Spotify grows its business and hits specific targets, the overall pie and distributions to labels grow, but the rate comes down. This is the win win relationship. This is an oft-missed fact about the relationship between the two parties. In the annual filing the business targets are called out:

The targets can include such measures as the number of applicable Premium Subscribers, the ratio of Ad-Supported Users to applicable Premium Subscribers, and/or the rates of applicable Premium Subscriber churn.

My guess is that as the business health improves via premium subscriber growth, premium MAU to Ad supported MAUs stays high, and premium churn stays low the royalty rate comes down, i.e the gross margin goes up. CEO, Daniel Ek, references this in the Q4 2024 call, in response to an analysts' question about the improvement in margins and how that relationship is built with labels:

"So first and foremost, I think one of the most common misconception that I quite often hear from analysts is that they believe that there is a win-lose dynamic between us and the labels. Ever since starting this company 18 years ago, that's not how we've looked at this. We always look at this as a win-win dynamic. And if you want to simplify it to the very core, everything for Spotify is, if we get meaningful scale, our margins and our profits goes from there."

And in fact this is what we see in the premium business gross margin over the past two years, from Spotify's Q4 2024 investor presentation:

But there's another driver behind the increased margins. Cost of royalties includes another important item:

Cost of revenue also reflects discounts provided by certain rights holders in return for promotional activities in connection with marketplace programs. Additionally, it includes the costs of discounted trials.

Discounts = when a label wants to promote an artist they give Spotify a discount on their royalty rate. As in this is increased margins for promotional activity. Instead of paying cash up front the label pays by receiving less royalties at the end of the payout period. As Spotify has reached greater and greater scale, the music discovery business has picked up and this lower cost of revenues which translates directly into increased gross margin.

All in all, the premium business, driven by music, has shown itself to have quite impressive gross margins that should increase over time as the business scales even further.

Part of what's been masking the gross margin story for the premium business has been the ad supported side which includes podcasts. Spotify started an M&A binge in 2019 for podcast related content which has flowed through the cost of ad supported revenue as amortization of these assets. The nadir of those costs were reached in 2023, and the ad supported gross margin has since climbed from ~0% to its current ~15% level. 15% isn't great, and that's because costs are only one part of the gross margin equation. Much like in the premium business, scale matters here as well.

Spotify still hasn't reached scale and efficiency in its ad supported business. This is due to a few factors. Audio has historically monetized at lower rates than other advertising formats due to the challenge in tracking the effectiveness of the ads. Spotify has been selling ad slots via a sales force to agencies in a direct fashion, rather than programmatically in an auction type setting. These two factors have made Spotify's ad slots underutilized, making it a challenge for the business to reach its proper scale. Additionally, it's harder to monetize Spotify's higher value premium users - since they pay for an ad-free product. This leaves only podcast advertising slots available for these users, which have been a harder technical challenge to aggregate.

I'll discuss where I see gross margins going in the section below about Spotify's future.

Operational efficiency

Operational efficiency has been a major narrative for Spotify over the past two years. But it hasn't only been a narrative. It's actually occurring. All cost buckets have come down in absolute terms and relative to revenue from their 2022 peaks. R&D as a percentage of revenue came down to 9% in 2024 vs 12% in 2022. Same for Sales & Marketing. G&A came down to 3% vs 5%. Stock based compensation has also come down. In 2024 it was €276 million, down from €321 and 388 in 2023 and 2022 respectively. 276 is 8% of R&D and SG&A costs and at current stock prices not even one percent of the company's market cap.

This is a story of increased leverage on Spotify's fixed cost basis. When added together with increased revenues and gross margins this paints a great picture for cash flow.

Cash: Balance sheet, FCF and SBC

Based on the above financials, it's easy to see why FCF has been growing at a very fast clip. It's reached a very respective 14.5% FCF margin during 2024. Spotify's leverage to drive FCF becomes even more impressive when you consider that gross profit was €4,741 in 2024 - meaning FCF / Gross profit was a very impressive 48%. This is a business with cash generating abilities.

The trend going forward becomes even more impressive when looking at the last 7 quarters. Spotify is turning into a cash flow generating machine. It's showing up on the balance sheet the company has €7,448 in cash with €1.5 billion in debt.

What is Spotify doing with all that cash? Not much. They announced a €1 billion buyback program in 2022, but only used €91 million. Bought nothing during 2024. This is a tiny buyback in light of the company's market cap, but considering the FCF profile of Spotify going forward this definitely has room to grow. CEO Daniel Ek is a student of capital markets and I believe will look to be opportunistic and aggressive on large downturns. The 2022 pullback, where he bought €50 million worth of Spotify shares for himself, has probably taught him to be greedy when others are fearful. I'm sure it stings that they didn't even utilize 10% of their ASR when prices were depressed.

What else could Spotify do with cash? Management hasn't discussed this much but here are some of my own ideas:

Vertically integrate: By purchasing stakes in labels or buying music catalogues, Spotify could make long term, positive ROI investments that impact their supply chain and take more control of their future.

AI creation tools: There's no doubt that remixing music via AI is going to be a big area for new creators. Spotify should be at the forefront of this, both to enhance the user experience and the creator experience.

Opportunistic content M&A: content can include podcasts, audiobooks, educational content or anything else really, including radio broadcast rights for large events. Anything that increases retention and LTV for the platform.

Geographic expansion: Strategic M&A is often useful to expand into new territories even further.

Enhanced shareholder returns: If all else fails, buybacks and dividends aren't a dirty word!

Summarizing Spotify's business

Spotify's business has reached an inflection point. Scale is transforming it into a highly profitable business. Its revenue engine is strong, with decreasing sales to acquire customers. Gross margins are expanding beyond the long-stagnant 25% due to improved royalty rates and music promotional discounts. At the same time, operational efficiency is driving down costs, boosting free cash flow to a 14.5% margin in 2024 and finally reaching profitability.

Spotify's future growth

After ~5,000 words we're finally reaching the crux of the analysis - where Spotify is going from here. I don't think you can understand where it's going without understanding where it's come from and the strategic positioning of its business, which is why I've spent so much time on it. Going forward let's review:

Revenue growth as a combination of:

MAU growth (premium and ad supported)

ARPU growth:

Premium and ad supported ARPU growth

New product offerings

Gross margin improvement

Free cash flow and operating income

Simply, Spotify's future potential is an algorithm made up of: MAU growth * Premium MAU ratio * ARPU per MAU segment * Operating margin.

Future revenue growth

MAU growth

At 675 million MAUs it's clear that Spotify has broken free of the competitive pack. They are without a doubt the largest music and audio streaming platform in the world. However, at some point, the law of large numbers kicks in and growth rates slow.

I like to take a top down and bottom up approach for growth stories like this. Top down, the question to ask is: how many MAUs can Spotify reach when the market is completely saturated? In a world of 8 billion people, once we remove regions like China and North Korea, I'd say that 5.5 billion could be eligible streaming MAUs within the next 20 years. Let's refine that more to remove a few populations where smartphones and streaming simply isn't viable in the near future and you still get a population of ~4.5 billion. Given that, it's not unreasonable to say that Spotify could reach 1-1.5 billion MAUs. For perspective, Facebook has ~3 billion MAUs. If the total music streaming market reached ~2-2.5 billion MAUs all together, Spotify's share would be ~1.2 billion users (source).

Why would Spotify stay so dominant? Two main reasons: the network effects discussed above and their determined focus on emerging markets. More than any other major player, Spotify has focused on markets outside of the US and EU. They're the clear leader by a wide margin in regions like Latin America and Asia (ex China).

Looking forward, from a top down perspective we can reach a 1.2 billion MAU count, but how long with it take us to get there? For this let's go bottom up and look at Spotify's MAU growth rate.

The below chart shows the declining MAU growth across both categories: premium and ad-supported. What's especially concerning is that ad-supported MAU growth slowed to premium subscriber growth for the first time since 2019. Management has frequently called out the ad supported as the top of funnel for the premium business, which could presage slowing growth in subscriber MAU.

The trend is definitely slowing, so it's reasonable to assume that it will continue to slow. However network effects and the virality of Spotify's product help mitigate that. By how much is hard to know. I like to use base rates as a comparison to get an idea of a benchmark, however that's not the easiest to find: how many global consumer products are there that fit the same profile as Spotify? Netflix has flatlined around ~15% growth over the past two years. Meta has compounded daily active users on their family of apps at ~5% over the past 6 years. So we're somewhere in that ballpark. I think 5% is too low, due to Spotify's market being far less saturated than Meta (Meta grew 5% off of a whopping base of 2.3 billion users). I also think 10% is too high - this isn't a network effect business like messaging. It's not a social network, despite having many social aspects. A CAGR of 8% seems as reasonable to me as any other estimate over the next 5 years, and if this seems wishy washy, well, sometimes forecasting the future is wishy washy. And if you've read up until here I feel comfortable admitting that.

An 8% CAGR gets Spotify to 1 billion users in 5 years, 24 years after the company's founding. Again let's look at base rates for perspective. It took Facebook ~8 years to reach one billion users. YouTube ~8 years, Whatsapp ~7 years and Gmail ~12 years. What's the growth rate from 1 to 1.5 billion? probably lower than 8% but higher than the natural birth rate. What's certain is that there are many years of music listener growth ahead. There's a lot of room to reach ~4 billion MAUs on music platforms. I feel very comfortable assuming an 8% CAGR for MAUs over the next few years which then slows to ~5% for the next five to ten years.

If all of this sounds outlandish to you, industry forecasts are even more bullish. From Universal Music Groups Capital markets day:

ARPU Growth

Once we have an estimate for MAU growth, we need to figure out how much those users are paying - as in the average revenue per user (ARPU). This is vastly different between the ad-supported and premium tier. First, at 1 billion MAUs, how many premium subscribers can we expect? I laid out above why I believe the ratio between premium subscribers and ad supported ones will continue to decline at a linear rate. Following that logic we get a base case Premium subscriber MAU of 34.16%, meaning 341 million premium subscribers. Let's be more conservative and assume that the ratio declines slightly faster because of market saturation and use a 30% ratio. This gives us 300 million premium subscribers vs 700 million ad supported ones. This implies a 2.65% Premium Subscriber CAGR over the next five years. Definitely lower than Spotify's conversion rate to date, but let's use those numbers going forward. Any shift in these numbers towards a higher premium subscriber ratio will benefit the business.

How much is each kind of MAU worth?

Premium Subscriber ARPU

Premium ARPU reached €4.85 during Q4, essentially flat over the past 2 years, but up quite a lot over the past 6 quarters. ARPU came down as Spotify pushed its student, family and duo plans. The main upside driver is that Spotify has finally decided to increase prices on their offering in their main markets. This includes offering the audiobook premium service in 10 markets, but not only. They raised prices prior to that on the music business, and going forward we can expect more price increases.

There are three drivers for increasing premium subscriber ARPU: general price increases, new product tiers and selling add ons. As management put it in the Q4 2024 call:

The way we think about ARPU growth going forward is, that it's a function between really three things. It's price adjustments, future tiering and then also selling add-ons to our existing subscribers. And with respect to price increases, specifically, as Daniel has mentioned before, this is now a part of our toolbox. We take great care in the steps to balance the value-to-price ratio.

Over time, this is something we've mentioned before as well. And when it comes to value, the way we do it is, we add value by way of features and content experiences. And you can see us in the last year here adding AI, things like AI playlist, Jam and so on. And we've continuously just increased the size of the number of audiobooks we have. We have 350,000 audiobooks now in 10 markets. We have 67 million video podcasts.

We pretty much have the world's entire catalog of music. And then as far as price goes, we adjust price where it makes sense. And then our subscribers reward us with more love, more engagement, and sticking around. And so really the key takeaway here is that we believe Spotify is one of, if not the most loved and highest-value in subscription entertainment.

What might this look like?

Both Spotify's and the record labels' management teams have spoken a lot over the past six months about entering the era of Streaming 2.0. UMG focused on this quite a lot at their capital markets day last year, so I'll share some of their thinking. Streaming 2.0 is all about reaching maturity in the streaming business. That means going global, slicing users into more monetizable segments and creating more fan engagement. Think about it as an airline that only served one route at one price point now entering different markets and adding premium economy, business and first class tickets as well as express check in.

UMG anticipates that a premium Spotify tier could have a 1.5x price point vs the standard one. But that's not all. Superfans have been a dramatically underserved user market in the Streaming 1.0 era.

Everyone pays the same price point and gets the same customer experience. But what if power users could purchase all kinds of artist related add ons? Historically Superfans spent 3X more than normal users, something that's all but disappeared in modern streaming.

Put this together and UMG expects price increases to keep pace with inflation plus the expectation that 20%-30% of customers will opt for a new premium streaming tier. From the UMG Q&A section of their Capital Markets Day:

inflation has run at 40% on a compound basis over that period of time. And clearly, going from $9.99 to 10.99 dollars is a 10% increase.

Put that together and you get 67.5% ARPU growth over a 5 year horizon: 30% price increase from inflation alone plus a 37.5% increase from 25% of customers who opt in to a 1.5X priced tier. Let's be more conservative than UMG and assume that:

General price hikes are 15% over five years. Spotify has always been a reluctant price taker and they've taken two in the past two years.

15% of users opt into a premium music tier, priced at 1.5X and another 5% opt into a similar bundle around audiobooks. In total 20% of users opt into a 1.5X priced premium tier.

This brings our premium ARPU in 5 years to €6.01, a 4.4% CAGR, very much in line with recent quarters.

Ad supported ARPU

Ad supported ARPU is much, much, lower than premium: €0.42 (monthly ARPU is calculated as quarterly ad supported revenue / quarterly ad supported MAU / 3 months). This is both disheartening and shows the huge, vast, blue ocean that Spotify has in improving monetization. Spotify simply monetizes these users at much much lower rates compared to any other form of media, including traditional radio ($10-20 per year per listener).

It's even harder to forecast this business going forward than premium subscribers. On the one hand there's lots of room for upside from an under monetized and inefficient ad marketplace. Spotify already has the ad slots, they just need to improve the pricing so sticking a 15% CAGR sounds perfectly reasonable, although admittedly arbitrary. On the other hand, audio is simply a lower performing ad slot. It's harder to track in terms of actions taken (because you're often doing it passively), the higher value premium users receive ads only in podcasts and technically this is much harder to do (many podcasts have ads that are host read and don't enable dynamic ad insertion) and the main market for ad supported listeners is in lower value emerging markets where the ARPU for ads even for the best advertising platforms (Meta and Google), is low.

Additionally, Spotify hasn't executed well on this segment over the past four years. They are rolling out key changes now, and focusing on it going forward, so hopefully this brings the turnaround I've personally been looking for for years, but there's still room to doubt the execution.

Here's the Q&A from the Q4 call that addressed this directly:

Bryan Goldberg

Advertising growth remains disappointing, while you're embracing programmatic, there seems to be a disconnect given the size and engagement of your audience and your rather lackluster advertising revenues. Can you help us understand why brands are not dying to be on Spotify given the momentum?

Christian Luiga

Thank you, Richard. Yes, I first start out to say, yes, we moved from brand sales into performance sales. It is clearly something that we recognized last year, we were late on the ball. So that is nothing to be sort of hiding away from. But from that, we actually made a decision then to move into programmatic and that takes a little bit time, but we are on the ball now. We have done the technical build-out.

It's largely completed and we also now then are getting to a unified supply on our server, opening up for more demand on the bidding. As you know, we have started out now at Trade Desk and we're going to look to add more partners onto our platform. And as I said last quarter, yes, this is a little bit late, but we have a stable transition and this year 2025 will be the year of building and 2026 when we think we're going to get scale. And I think we're delivering on time now when we know what to do and we have happy partners and we are happy.

Ad supported ARPU has been shrinking over the past two years, so there's no base case for it to grow, therefore I'll take into account three scenarios:

Base case: 0% ARPU growth → ARPU of €0.42

Positive case: 8% ARPU growth → ARPU of €0.62

Bullish case: 15% ARPU growth → ARPU of €0.84

Upside scenarios for ARPU growth

So far, I've taken what I consider to be a conservative approach in analyzing ARPU, but there are upside scenarios that I have not included:

Audiobooks: Currently, Spotify's audiobook pricing is greatly undervalued for just one more dollar - listeners get a very large catalog and a very decent amount of hours per month. Compare that with Audible, the leading audiobook company (also owned by Amazon) which costs $8 - $15 a month. What if the audio book bundle increases in value and comes closer to the price of Audible? This would be a large benefit to pricing power and ARPU.

Selling ad ons: You come to Spotify to listen to things, but what if you also came to Spotify to purchase things? These could be additional audiobook credits, but it could also be artist swag or concert tickets. Imagine if Spotify was the Shopify front page for artist stores. I don't think that Spotify would be building the tooling and competing with Shopify. Rather, they would integrate existing tools and enable commerce within their website and applications.

This has started rolling out already for concert tickets, but it’s far from being an artist’s store front.

While the business model is complex because of the myriad of players who would receive royalties (these royalties are different than streaming ones in the music world) as well as Apple and Googles regulation on in app purchase. I could see Spotify shifting from just an affiliate to becoming more integrated and earning a larger percentage on making this commerce happen. This would increase ARPU across all users.

Education: Spotify is testing audio courses and educational content in the UK. I've previously run an audio education content company and the stickiness and willingness to pay for this content is high. Whether this increases ARPU similar to the current audiobook model or whether they get sold as add ons, audio courses will enhance the ARPU across the board. For ad supported users this could be very meaningful in terms of the data associated with an account. A user who listens to product management courses can be more effectively targeted for relevant products.

Enhanced music discovery: Today, Spotify offers music discovery features to the major record labels. But what if in the coming years they open up a so-called music discovery marketplace similar to Google's ad marketplace, where artists and indie labels can promote their music via Spotify's music discovery features. In many ways, this is the ideal "ad" format for music streaming: You listen to indie folk rock. Great! Let's recommend a song in the genre that an indie artist is promoting. You just might ♥️ like ♥️ that song, adding it to your future playlists and streams. What's the life time value of a song that you stream for an artist?

At $0.00318 on average per stream I've done some napkin math and it varies between $2.5 - $30 over the lifetime of a song depending on how much a user liked the song, how much a user listens per month, how many other songs of the same artist they start listening to because they were introduced to that artists music and buying add ons like merchandise and tickets.

If Spotify monetized their smart recommendations 'ad slots' that's massive, especially for ad-supported users.

I think some of the upside scenarios, audiobook pricing and education, are quite likely to be impactful in the next five years. Enhanced music discovery and selling add ons are harder to model reliably, but are longer term drivers of Spotify's ARPU growth.

Revenue in 5 years

Bringing the revenue picture together we get quite a complex matrix of 81 scenarios from our four variables, each with three modeled outcomes:

MAUs: 800 million, 1 billion, 1.2 billion

Premium to ad supported ratio: 30%, 32%, 34%

Premium ARPU: 6, 6.5, 7

Ad supported ARPU: 0.42, 0.62, 0.84

I've done the math, and the expected value of a simple average all the 81 scenarios comes out to €30.07 billion. In my personal python model you can add weights to each variable outcome (happy to share if you're interested, just comment below or dm me) - my expected revenue number (excluding upside scenarios) comes to slightly lower at €28.9 billion, a 13% CAGR. This is much slower than the 18.7% five year CAGR Spotify has been growing at (taking a 15% CAGR Would get you to €31 billion. In my model utilizing some of the upside scenarios brings revenue CAGR back up to ~18%).

How likely is Spotify to execute on all the different initiatives I've mentioned? I like to look at past execution for the company to inform how they can perform going forward. Since 2019 Spotify has:

Gone full force into podcasts, bought and integrated several companies, revamped their UI and become the #1 podcast player globally.

Launched Audiobooks in 10 markets

Renegotiated key contracts with the big three record labels to bring Streaming 2.0 to their user base

Launched multiple successful app updates, including yearly wrapped campaigns and AI DJ.

Started testing educational content in the UK

Tested social audio

Added video to the app and pushing into video podcasts and creators

Increased operational efficiency,

Spotify has a good track record of execution and looking ahead at the next five years I think the current roadmap of enhanced premium tiers, audiobooks, courses and Streaming 2.0 is very doable. I'm excited to see what they roll out!

What about profitability?

How does that revenue growth translate into profitability and FCF? I'll assume that Spotify manages to grow it's gross margin for both business lines as it scales. Based on the analysis above of their relationships with labels and their ability to aggregate content, Spotify could reach a 35% company wide gross margin in 5 years. I don't expect operating costs to keep coming down, but rather to stay flat or go up marginally.

Based on this Spotify would reach an operating income of €6.196, in other words an operating margin of 21.5%. Based on the dynamics of FCF that we discovered above, most of this, ~€5 billion, would be FCF. Over the five years of growth the company will amass a war chest of at least €15 billion.

What can go wrong?

Before moving onto valuation let's spend some time thinking through what can go wrong and the likelihood as well as milestones and road signs to let us know where we are along the journey.

Bearish scenarios

MAU growth disappointing:

Competition: Most likely this happens due to competition. YouTube is the only real competitor in my opinion due to it's content aggregation approach, their pivot into podcasts and video podcasts and their existing massive distribution base. Currently YouTube Premium is priced higher than Spotify, but If YouTube figured out a way to monetize free music and podcast listeners via ads, this would enable them to push massively into new markets hurting Spotify's MAU growth. While Google is the best company situated to figure out a new advertising format, figuring this out would be to YouTube's direct detriment - they'd be disrupting themselves. YouTube Premium offers background listening and advertising less listening. If they offered background listening, but didn't charge for it and instead monetized off of ads, they would be willingly entering into the audio advertising format that is much less profitable than their existing video ads. They'd be taking on a new vertical that would decrease margins and ad efficiency. In the grand scheme of things, for a platform that earned $36 billion in 2024 - more than double Spotify's revenue, I believe this is simply not an interesting enough revenue opportunity for YouTube to disrupt itself.

Churn: Retention has historically been a strong point for Spotify and it's only improved as Spotify began aggregating audio content, however if this metric changes this would hurt the LTV of the company. We'd probably see this first in a slowing growth rate in Premium Subscribers as well as a lower Premium to Ad supported ratio.

ARPU growth disappointing: Streaming 2.0 is a big hope for the industry, but what if users are perfectly happy with their current experience? What if the Superfans aren't really looking for more streaming options and just want better concert tickets? This would hurt ARPU growth. Any failure in growing ad supported ARPU, whether the video podcast ad slots or the general music ad slots will make growing ad supported MAU ARPU a challenge.

Labels: Any shift in the power dynamics between Spotify and the record labels could cause large problems. What if the labels see Spotify's growing revenues and margins and get jealous, looking to renegotiate to earn themselves a bigger deal? What if the relationship becomes more zero-sum and less win-win? While I don't think this is likely, it is something to keep an eye out for.

Public sentiment: I'll quote a recent discussion about Spotify on the Prof G Markets podcast here:

"We should probably think about what could go wrong for Spotify. I think one potential issue is this growing public resentment towards Spotify, and specifically towards Spotify and how they pay their artists. So, a lot of people say that Spotify squeezes their artists. They don't pay them enough. They reward the top 1% and the other 99% get screwed. And that's timely because Chapel Roan, who just won the Best New Artist Award at the Grammys, she actually called this out. She didn't call out Spotify specifically, but she called out the whole music industry of which, of course, Spotify plays a huge role. So let's just listen to what she said: "I told myself, if I ever won a Grammy and I got to stand up here in front of the most powerful people in music, I would demand that labels and the industry profiting millions of dollars off of artists would offer a livable wage in healthcare, especially to developing artists."

Spotify has entered the public lime light in less flattering ways several times over the past decade. Taylor Swift famously took her music off the platform, Neil Young removed his catalogue over Joe Rogan's interviewing of doctors who didn't condone blanket vaccinations around Covid. Every so often the debate about the dynamics of the music industry flare up again. If public sentiment among users or artists ever really picked up steam this could be a negative. I don't think this is likely. All of the previous flare ups have blown by and the company has kept on growing. Unless Taylor Swift removes her music again, I think Spotify could weather anything else.

Streaming music disruption: The format for music consumption has changed multiple times over the past half century: vinyls, tapes, CDs, digital downloads and streaming. What if a new format emerges? I've spent a lot of time putting on my 'futurist' hat here and it's hard to come up with an alternative model. The main problems around streaming are that you have to pay for life. There's no ownership of YOUR catalogue anymore. The benefits however are immense: for one monthly price you get to listen to EVERYTHING, anytime, anywhere. You don't have to reload songs or manage your catalogue. Just search, like, save and play. The only mode of music that could disrupt streaming that I've been able to imagine is something that connects the best of both world: what if you could purchase the rights for streaming a song, in perpetuity, yet have it hosted on some cloud or stored on device and enjoy the technical user experience benefits of streaming? Perhaps this would be a hybrid model of pay per stream, or a trial streaming subscription to test new music with the obligation of purchasing the rights for songs you like and listen to over and over? I could see a model like this becoming the new normal at some point, however I could also see this becoming a net positive for Spotify. It's probably easier to pivot into adding a new 'purchase a song' tier than it is to acquire the millions of customers Spotify has.

Milestones

Every journey has milestones and signposts along the way to let us know we're on the right track. For Spotify I'm looking at all of the metrics we've discussed:

MAU CAGR of 8%+

Premium subscriber CAGR of 2.5%+

Premium ARPU CAGR of 4.5%+

Ad supported ARPU growth of anything! I want to see how the rollout of programatic ads goes.

Gross margins and FCF conversion

Product innovation: new music tiers, new audiobook offerings and the rollout of educational products.

Following these signposts will inform whether we're on track or not.

Valuation

Now, after 9.400 words and 15 charts we come to the crux of the issue. How can we value Spotify? Let's use the expected revenue and operating income above of €6.196. What kind of multiple or P/FCF is the market willing to give a company like Spotify? This is a unique brand in the growing music space, forecasted to grow over the next 5 years at a 13% CAGR, improve margins and generate significant FCF that can be used to buyback shares or grow the business.

They have a strong, durable moat and are uniquely positioned in their category to withstand fluctuations in the market, whether macro economic, technological or geopolitical. This is a very, very durable business, with long term durable growth.

In light of this positioning, it’s relevant to comparable to other best in class durable growers with wide moats. The market gives Amazon, another durable business a 51 P/E. Netflix has a 55 P/E. Apple has a 36 P/E. Adobe 25. Below is a variety of different P/E with the relevant market cap of the company and the expected gain/loss from Spotify's current €126B market cap.

Note: I'm using "P/E" for convenience as the term is widely used, despite actually calculating the operating income and FCF. A FCF yield calculation will yield similar results. I prefer using operating income over EPS which I have less visibility into due to SBC and future buybacks.

1. 10 P/E: €62B (-51%)

2. 15 P/E: €93B (-26%)

3. 20 P/E: €124B (-2%)

4. 25 P/E: €155B (+23%)

5. 30 P/E: €186B (+48%)

6. 35 P/E: €217B (+72%)

Given the durability of the business and it's long term growth perspectives a 30 and above P/E is something I'm willing to pay. It's slightly higher than a 2 PEG, historically a relevant area for outstanding companies.

Another method I like to use to value a company is the reverse DCF. When running it I've decided to use the following assumptions: a terminal growth rate of 4% to reflect the growth to market saturation and a discount rate of 8%. For the calculation of trailing FCF I use the forward looking FCF margin I believe the company will reach over the next five years. Putting it together, Spotify has to grow top line by 10% for the next 10 years to justify it's current valuation. If that sounds farfetched, all that means is 5% MAU growth with 5% ARPU growth across both business units. That doesn't sound farfetched to me. Even at the end of those ten years with that growth rate Spotify would only reach 1.2 billion MAUs.

To bring this discussion together: is Spotify cheap? Definitely not. But in many ways, it's still undervalued. I've made what I believe to be conservative assumptions throughout this entire analysis, and despite my conservative approach the base case for Spotify's fair value based on its five year prospects is a company who's market cap is anywhere from up 50% - 75%. A reverse DCF shows that Spotify can be expected to compound at 8-10% per year, for the next 10 years, fitting the same analysis.

What will I be doing with the stock?

Spotify makes up a whopping 40% of my portfolio. I'm definitely not 'at peace' with both the concentration risk and the fear of missing out on higher reward opportunities. However, it’s still undervalued!

The main reason why I’m not trimming this to sleep better at night is that Spotify has shown all the signs of a multi-bagger. It is a company that exemplifies a wide moat, long duration growth business. Despite the challenge to hold on for the ride it’s exactly these kinds of businesses that are worth holding onto for multiple years and even decades. Sometimes the ability to do nothing is hardest.

That's what I intend to do with Spotify, and you're welcome to join the ride if this deep dive has been convincing.

If you've made it this far, in return for the value of this deep dive I'd love to ask two things:

I'd love to hear from you about this deep dive and Spotify. What's your take? Pushback?

Share this with a friend or colleague.

Thank you for taking the time to post this. This is a great analysis and a very thorough writeup.

The framework you used to get to your numbers seems reasonable, and obviously there's a ton of hypotheticals one could get into.

One point of "pushback" (food for thought) is on the multiple. At €6B of EBIT (effectively EBITDA) with a TAM that would seem to be well penetrated with 1B users, should the incremental EBITDA $s be valued at 20-30x EBITDA 5 years out?

If SPOT revenue growth is < 10%/yr at that point and decelerating, 20x seems too high (ADBE has some existential narrative concerns due to AI but they're hitting the < 10%/yr wall + decelerating and are trading < 15x EBITDA).

On the other hand, to your point, SPOT should generate a tremendous amount of FCF, and your analysis as you note gives them little credit for redeploying this in other adjacent ways to grow the business or simply return to shareholders.

I only recently began digging into SPOT, but key for me (in addition to many of the things you identified are two fold): 1) diving deeper into the relationship between the labels and SPOT (you touch on this but given the concentration, understanding this relationship is a critical part of the investment thesis); and 2) understanding the extent to which SPOT can become a "multiple trick pony" to some degree as AMZN, AAPL and MSFT have.

Not to suggest that SPOT should attempt to move into a completely different industry or vertically integrate as NFLX has, but it seems that as the industry becomes more mature SPOT may need to lean on other levers to maintain the incremental degree of long term growth as implied by its valuation.

Amazing breakdown and analysis. Just restacked.