When bulls start questioning

Adobe had a rough 2024, which is unfortunate, because it's a stock I owned for most of the year. I first bought in during February of 2024, and increased my position during Q2, outlining my thesis here: Buying Adobe carefully.

But after a rough year, I began wondering whether the market is getting this right and I'm....wrong. This deep dive is my sleuthing journey into whether I got it right or wrong. I cover:

What made me reevaluate my thesis

A deep dive into Adobe

Exploring Adobe's future growth prospects

Valuation and market moves

Starting to question: Q3 2024

The first hint that I should be reevaluating Adobe came after Q3 2024 results. Adobe reported a good quarter with a strong double beat and yet the stock dropped 10%.

From Investors Business Daily:

Digital media and marketing software firm Adobe (ADBE) late Thursday beat Wall Street's targets for its fiscal third quarter, but its guidance for the current period missed estimates. ADBE stock fell in extended trading.

The San Jose, Calif.-based company earned an adjusted $4.65 a share on sales of $5.41 billion in the quarter ended Aug. 30. Analysts polled by FactSet had expected earnings of $4.53 a share on sales of $5.37 billion in fiscal Q3. On a year-over-year basis, Adobe earnings increased 14% while revenue rose 11%.For the current quarter, Adobe forecast adjusted earnings of $4.66 a share on sales of $5.53 billion. That's based on the midpoint of its outlook. Wall Street was modeling earnings of $4.67 a share on sales of $5.6 billion in the fiscal fourth quarter. Adobe's guidance would translate to year-over-year growth of 9% in earnings and 10% in sales.

The company maintained full year guidance and reiterated record Q4 and FY expectations. So what sent the shares down 10%? This was particularly poignant as Adobe had a double beat on this quarter.

In situations like this my gut instinct is that 'the market is being short term oriented'. But I wasn't sure, so I opened my Adobe tracking excel. In parallel I turned to the conference call, trying to understand between the lines what was so disappointing.

Part of investing in a large cap company like Adobe is acknowledging that it's well covered and understood by the analyst community. They know their stuff about Adobe. Especially because it's been a highly predictable business for the past decade throughout their shift to the cloud.

Listening to the call, it was clear that the answer lay in the shift in results between Q3 and Q4, which implies a 3% negative growth rate between Q4 2024 and Q4 2023, and how this put into question the company's growth rate next year and into the future. The first question on the conference call called this out:

Alex Zukin: Hey, guys. Thanks for taking my question and congrats on what looks like a very strong quarter. It’s one question, but it’s a two-parter. The quarter itself, particularly on the Digital Media ARR looked very strong. It looked unseasonably strong because you haven’t grown net new ARR sequentially in the 3Q, I think, in almost four years. So maybe just comment like what drove this unseasonable strength. Is it pricing, AI traction, and particularly the Document Cloud net new ARR? But at the same time given all the product momentum you went through in the script, it’s a bit confusing to understand why the Q4 guide is the lowest it’s ever been sequentially for Q4 on net new Digital Media ARR, which I think makes people a little nervous about maybe the go-forward, the next year performance.

And so maybe just address this dichotomy because it looks kind of seasonally a little bit different than what we’re used to. And I think it’s weighing on the stock after hours.

In other words, historically, Q3 is a relatively weak quarter, where sales decline vs Q2 and Q4 is the opposite. In 2024 that's shifted - Q3 has been incredibly strong and when Adobe didn't change their overall 2024 guidance, this implies that Q4 will be relatively weak.

Management addressed this quite directly, refuting weakness, claiming that they're maintaining their record guidance for Q4 and that the shift is due to a few deals being pulled forward and cyber Monday being pushed out.

Shantanu Narayen: .... And so, that also played out exactly as we expected. And it was a strong end. When you look at it as it relates to the last few weeks' performance, we saw the typical strength that we would see going into Q4. I can see how you're saying you're looking at the sequential guide.

We're looking at it and saying it's the strongest ever Q4 target that we have put out there for Q4, Alex. And so, I think we just continue to focus. We would expect Creative to again grow when you talk about growth-over-growth net new ARR in Q4. And all of the new initiatives that we're talking about, AI, etc., continue to perform.

So, from our perspective, when we look at what we guided to the second half of the year, to your point, Q3 is stronger. We expect a seasonally strong Q4 and then our continued innovation should continue to drive growth.

David Wadhwani -- President, Digital Media: ... And frankly, it's playing out as we expected in terms of the aggregate Q3, Q4 number. In terms of the specifics on timing, Q3 was a little stronger than you expected, and for a good reason given seasonality. I think a lot of that can be explained by a few deals that would have historically just closed in Q4, closing earlier than expected in Q3. And that changed the dynamic in terms of the linearity that you would typically see between Q3 and Q4.

For anyone who's listened to Adobe conference calls this year, the tones of the analysts and CEO Shantanu Nurayan is familiar. This isn't the first time there have been doubts about future growth prospects or that the CEO has pushed back with 'we've done this before we'll do it again' style comments. AI has been an overhang on the company all year long.

Two things were apparent to me from this call. The first is that analysts know Adobe inside and out. They've been following it for years and pinpointed exactly what was weighing on the stock. The second is that shifting revenue from quarter to quarter is cosmetic. The stock reaction was implying a larger question: what are the actual future growth prospects for Adobe? That's the question that analysts were trying to get at. That's the question I'm looking to answer.

To answer the question I'll examine Adobe's current position and future prospects, focusing on four key areas:

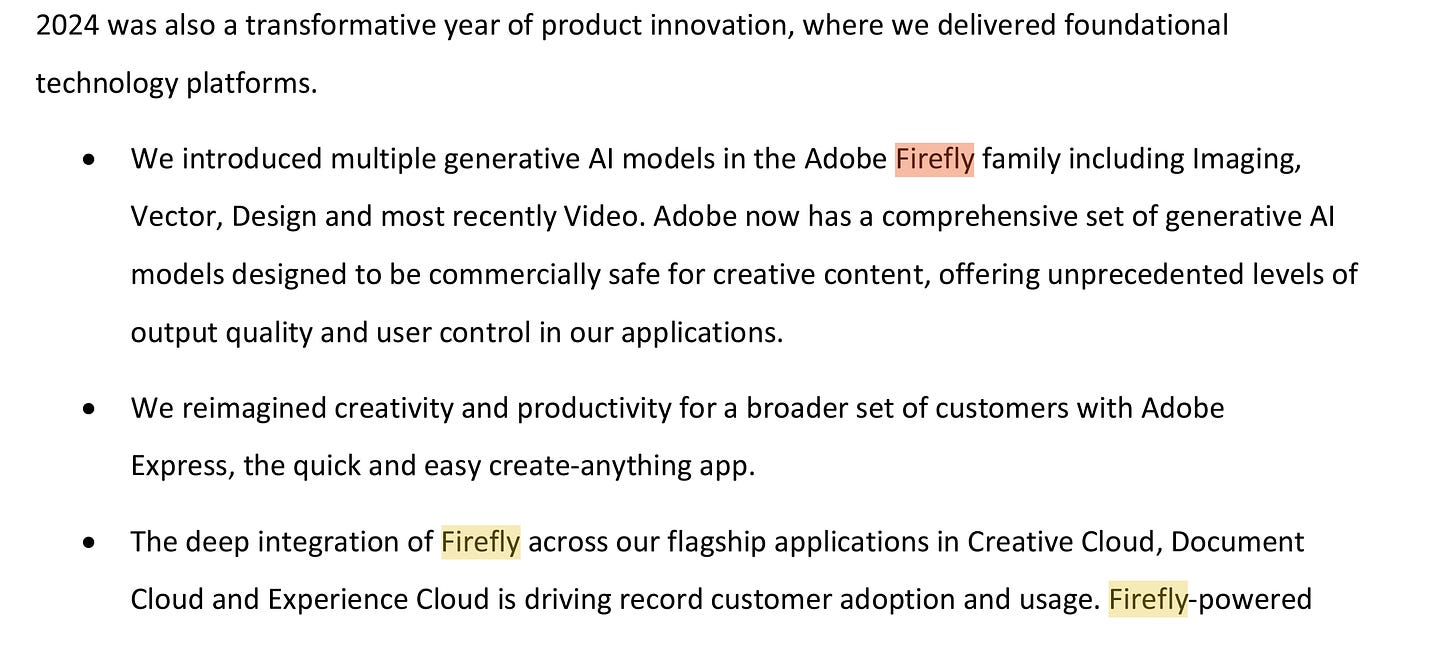

Revenue growth expectations: I'll analyze the growth profiles of Creative Cloud, Document Cloud, and Digital Experience, including the potential impact of AI and Adobe's Gen AI product, Firefly, on future revenue.

Moats, Growth Durability, and Market Position: Future revenue growth only matters in as much as a company's moats are durable and growing. Does Adobe fit that? How does AI play into this?

Valuation and portfolio Assessment: Putting it all together, is the valuation reasonable, especially in light of my current portfolio and investment thesis.

The central question I'm addressing for myself and Adobe investors is: Is Adobe positioned to be the next Microsoft, continuously reinventing itself and finding new growth avenues, in which case the premium valuation it's trading at is justified or is its growth avenue limited, meaning that it's durability of earnings is more in doubt, meaning a lower value for the stock.

I. Adobe's Revenue Growth Expectations

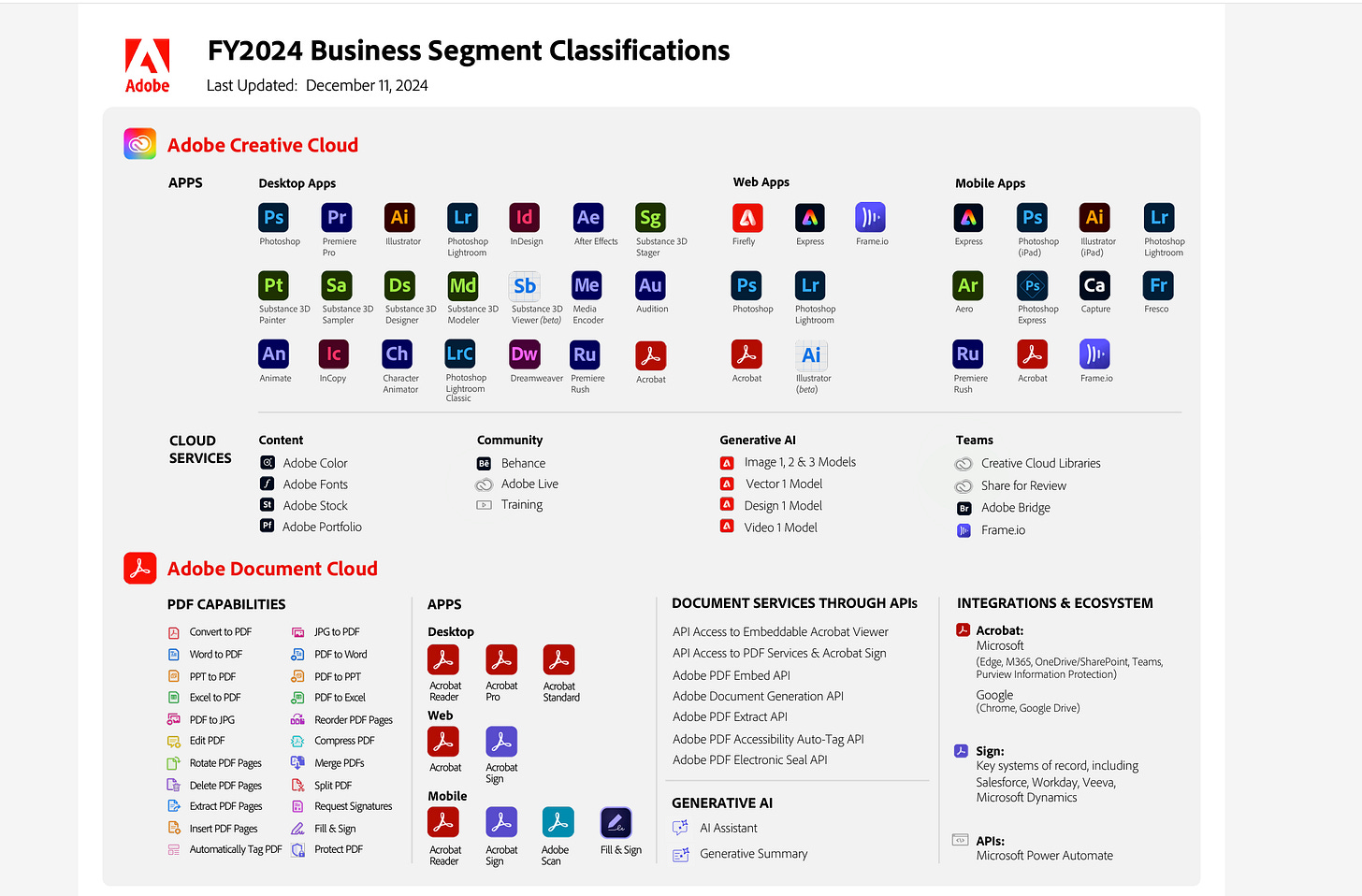

Adobe's revenue growth is derived from three main business segments: Creative Cloud (think Photoshop and Illustrator), Document Cloud (Acrobat Reader), and Digital Experience (Enterprise solution for marketing funnels). Each is a distinct business line with different dynamics. AI also plays a unique role in each business segment. What's common to all three has been the overall shift in revenue that Adobe has conduct over the past decade - shifting from product to subscription revenue.

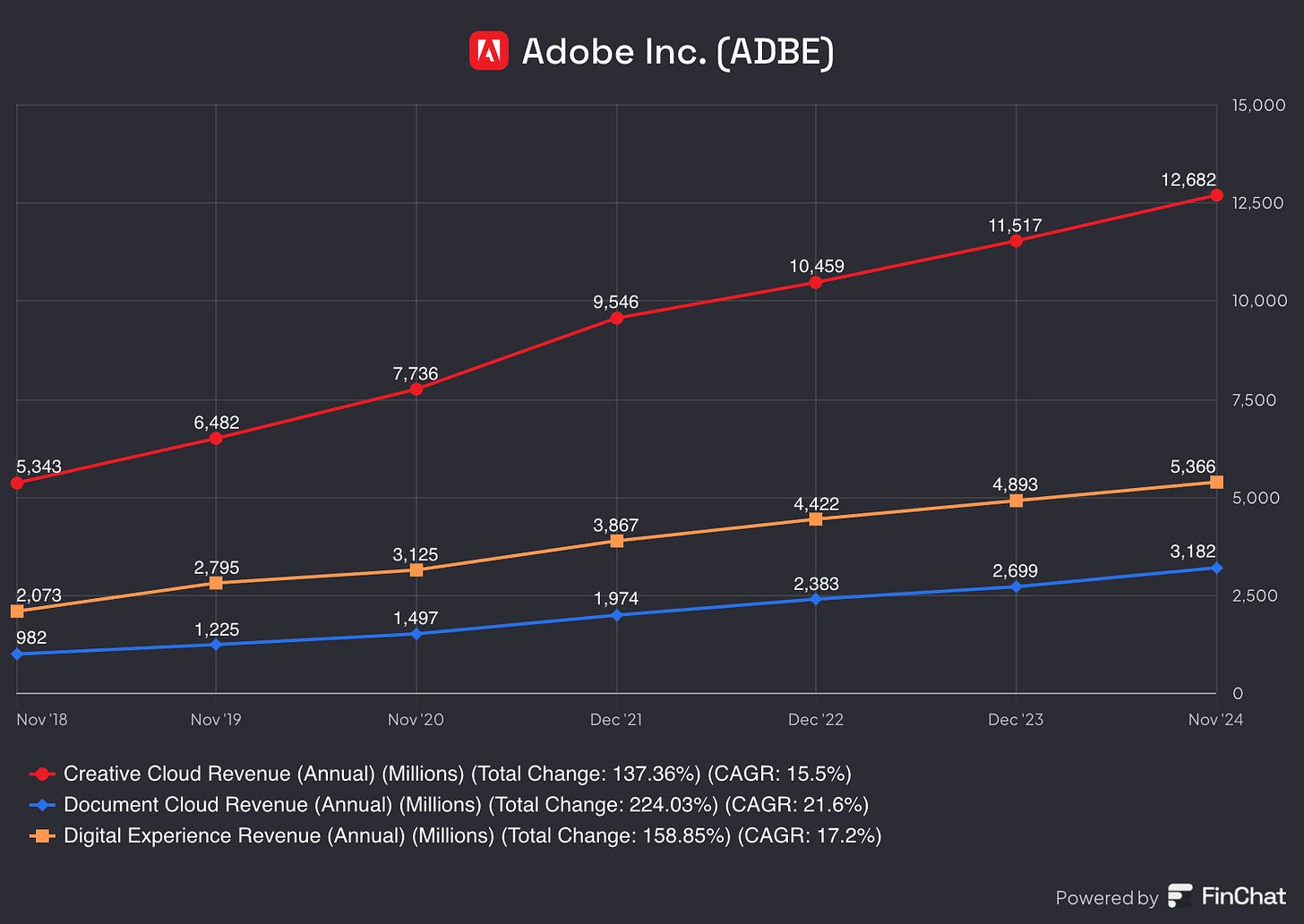

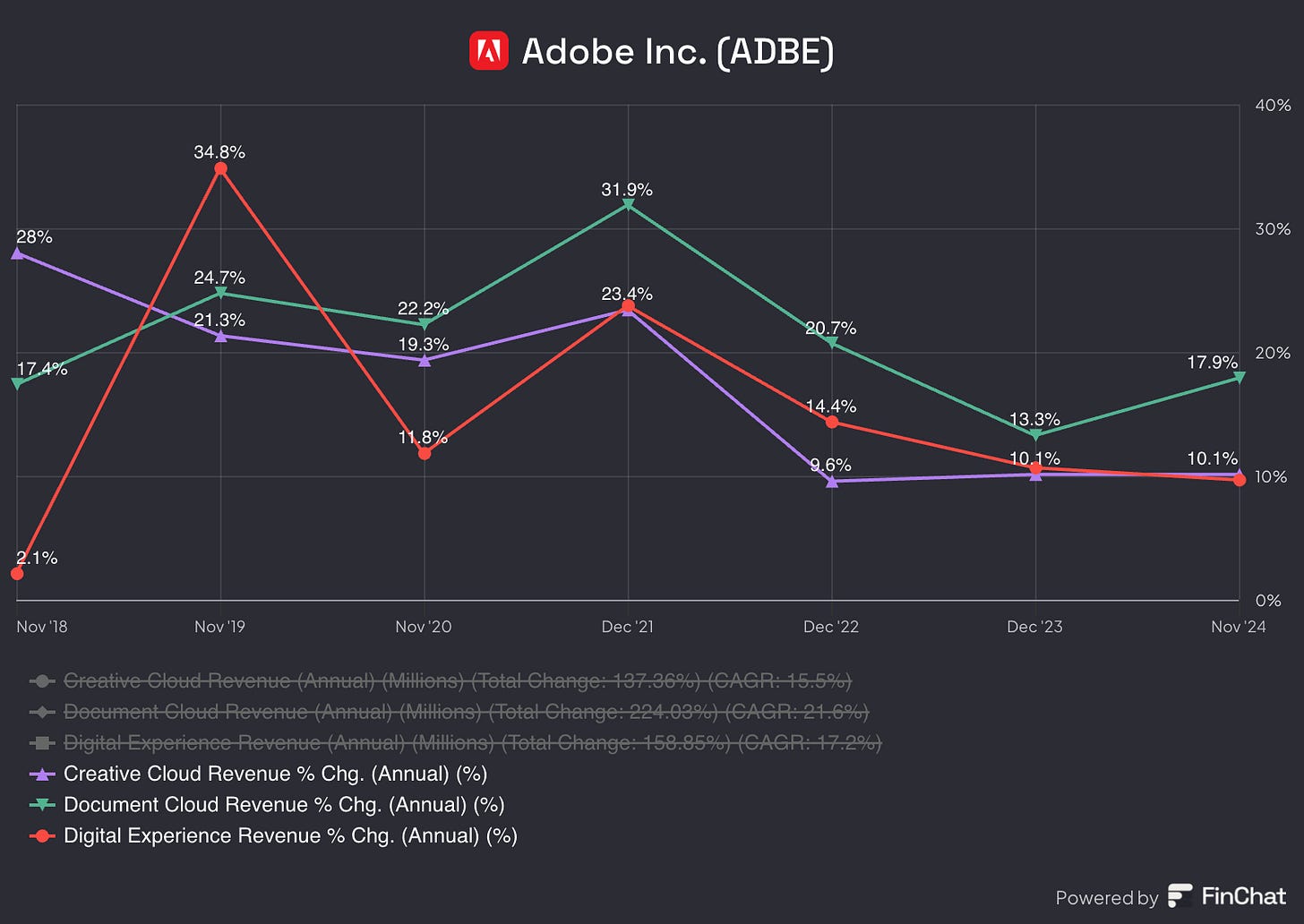

Adobe's revenue has grown at an impressive 18% CAGR over 10 years but it's slowed down to a ~15% CAGR over the past five years. In 2024 it grew 11%. So what's the growth profile going forward?

Let's explore the three main business lines.

A. Creative Cloud

Creative Cloud is ~60% of Adobe's business and the real legacy business: Photoshop, Illustrator and other creative design tools that have been around for quite literally decades.

Creative Cloud's Annual Recurring Revenue (ARR) grew 13% year-over-year during 2023, slowing down to 10% during 2024. Important to note that price increases were implemented earlier this year, which is part of the driver behind 2024 revenue growth.

What's been driving growth? Adobe's Creative Cloud is the premier suite of design tools in the industry. Without doubt. As the creative economy blossoms, media becomes more prevalent and personalized, there's an ever growing need for more well designed produtcs. This has been an industry tailwind. They've also been busy introducing new product offerings and improving existing ones. Two notable call outs are Adobe Express and Adobe firefly.

Adobe Express is Adobe's answer to a mobile based design tool, a segment that Adobe has long under served. Express is aimed at the market segment who to date would be served by tools like Canva or a plethora of smaller design apps that mobile creators or social media managers might use.

Adobe Firefly (which we'll be diving more into below) is Adobe's generative AI tool that plugs into their creative cloud. This has served as an excellent lead generation tool to bring in new users to Adobe's acquisition funnel, or at least it's mentioned in as much in several of Adobe's conference calls.

Here's an example from the 2024 Q4 call:

Creative cloud has two main user segments: freelance and personal designers and corporate account seats. Both are impacted by recessions, should they occur and benefit from the macro tailwind of a growing need for well designed media. Are these segments growing and at what rate?

2022 - 2024 has been a challenging period for most SaaS companies that charge on a per seat basis. Adobe has grown strongly despite these headwinds leading to two thoughts: either Adobe has a much stronger growth profile than we'd expect or that their segment isn't correlated as highly to the base growth rates of other SaaS companies. I'd hazard it being the second option. While seat growth in companies are correlated and as companies cut back hiring or cut their workforce, designers are definitely impacted, unlike other SaaS products, laid off designers can switch to becoming freelancers and use personal accounts, offsetting the impact of reduced seat count.

Longer term growth of both these user segments are affected by a few macro factors:

Overall economy: the more seats in a corporation, the more Adobe accounts.

Globalization of designer workforce and the growth of the creator and freelance economy: Fiverr, Upwork and other platforms that enable designers to work as service providers and agencies are enabling a new workforce to enter the global economy as designers - and they all can use Adobe's Creative Cloud.

On a micro level growth is impacted by:

Entering new segments: Creative Cloud has been dominant in the high end design segment but they've been lacking low end and web based collaborative design tools to work cross functionally (for example for developers to collaborate with designers).

Entering new markets: Adobe has distribution among millions of designers, if they could develop a new market segment relevant for this group of users, this could be meaningful for their company growth. This is a measure of 'company reinvention' that isn't easy for many companies. Microsoft has managed to do this multiple times, Teams and Copilot being the most recent dominant example, but most companies don't manage to do this.

Counterbalancing these growth levers are several significant headwinds. In many ways the professional creative market may be reaching it's mature, saturated phase, limiting growth. Which isn't to say it's shrinking, rather that there is an upper bound to growth rates.

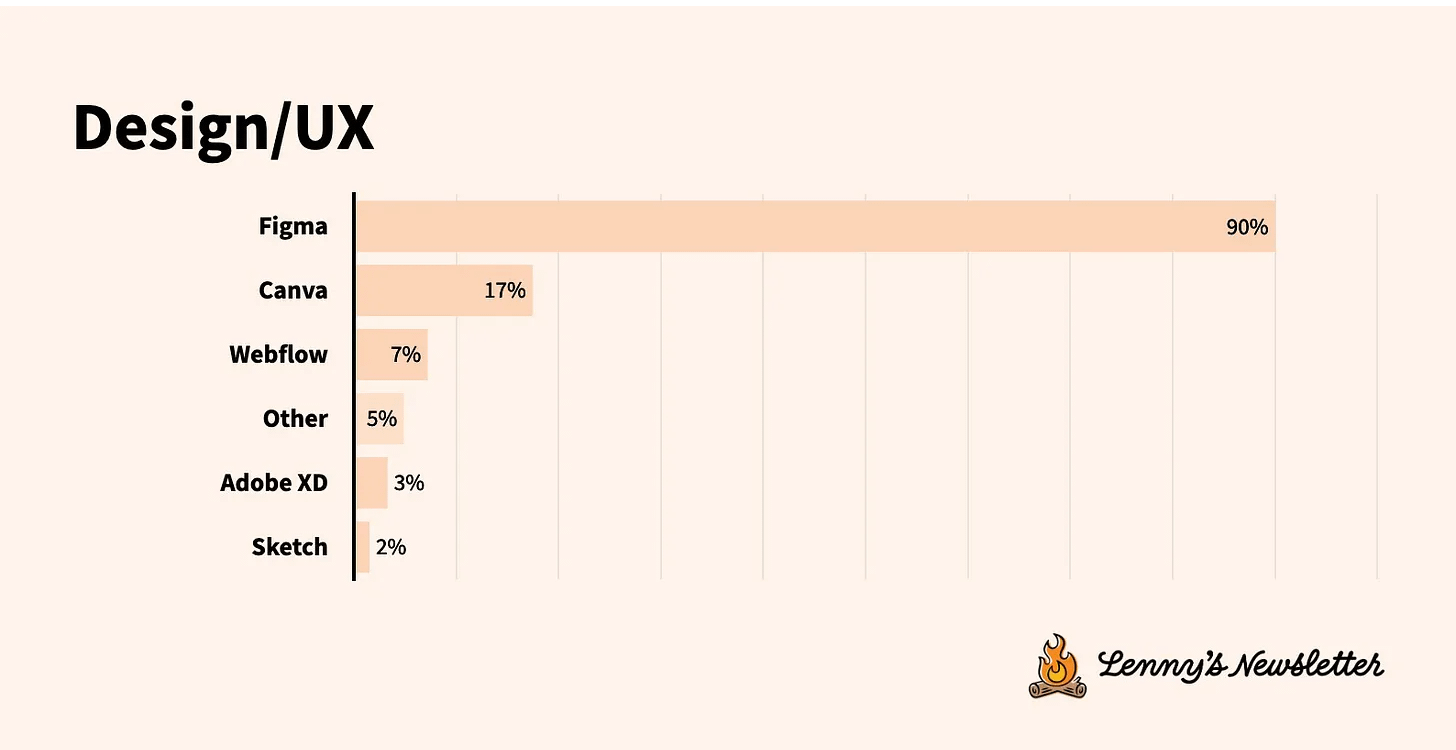

Adobe faces pressure from competitors in two key areas where they've been slow to respond: collaborative web based design and low end designers. Figma has been synonymous with the former and Canva with the latter. Both companies are far from being near Adobe in size or market impact, so there is room and time for Adobe to address these competitive threats, yet there is no doubt that both companies have been pressuring Adobe's growth in these key segments.

In a recent survey of tools designers at startups use, the answer is shockingly clear cut. Almost everyone is using Figma for design and no one is using AdobeXD. This is the low end of design but speaks volumes to Adobe's challenges in this market.

During the most recent quarter of Q4 2024, the low end and pricing pressures came up clearly in the call:

Kirk Materne -- Analyst

Yeah. Thanks very much. David, I was wondering if I could just follow up on your last comment on sort of obviously driving new users, new adoptions, you know, incredibly important. I just -- is there pricing sensitivity? Meaning, you're delivering so much value.

I think that pricing, given the value you're delivering, would be a bigger lever, you know, unless there's pricing sensitivity. So, can you just walk through that a little bit more because it feels like you should be able to get sort of all three vectors going at the same time, whereas I know you're going to focus more on bringing people in and making them successful. But I'm sort of -- I guess, is there something else on the pricing side that I'm missing while you're not getting that as well? Thanks.

What analysts are getting at is: Adobe management keeps on calling out the incredible power of their suite of tools and Firefly in particular, and yet they can't seem to reach the growth level that the market is expecting. Hence, is the pressure here coming from the low end from competition like Figma and Canva? The answer seems clear - yes. Management admits as much:

David Wadhwani -- President, Digital Media: ...And there is certainly price sensitivity at that side of the market when it comes to both premium users and also converted to paid users, and we'll continue to enable that. When it comes to the core business, and this is the business of creative professionals, we are very focused on introducing new value that is going to create more segmentation and more tiering and, you know, get aligned value and pricing to what we are delivering there.

Where does AI play into the Creative Cloud story?

AI enhances Creative Cloud through Firefly, Adobe's Generative AI tool, which integrates seamlessly to significantly boost product value. I've written about how I believe AI is a net positive to Adobe here, with the main points being that:

AI helps legacy players far more than incumbents as it's easier to implement a LLM with 'off the shelf' best in class models than it is to achieve distribution for a new product.

For Adobe specifically, AI offers enough value to users that it justifies a higher price point, maintaining or even increasing gross margins.

But AI can also help Adobe address the lower end competition from Canva and Figma. Adobe's products have a high learning curve, making onboarding challenging. AI can fix this and help Adobe onboard a new cohort of lower end users, solving their needs.

The flip side here is that AI can also help Figma and Canva catch up to Adobe's AI tools faster - lowering the bar for beginning designers and product managers to achieve the design quality previously only available with Adobe tools.

Adobe has yet to monetize Firefly, so it's hard to tell how this dynamic is playing out. I'm certain that we'll see pricing in 2026 as the Firefly offering reaches maturity, yet the fact that Adobe is so hesitant to raise prices already, despite good usage of Firefly speaks to the competitive dynamic on the low end I mentioned above. As David Wadhwani the president of the Digital Media segment put it:

David Wadhwani -- President, Digital Media: If you really take a step back, that's one of the best guides we've given in terms of, you know, next-year ARR growth. But one thing maybe to keep in mind is the composition of that growth is going to be a little different next year compared to FY '24. Again, the growth algorithm is new users, new products, and value and pricing. New users and new products will be a more significant part of the mix as we go into FY '25.

Pulling the threads together for Adobe's Creative Cloud segment, I believe it's reasonable to expect that it continues growing at market trend, perhaps even slightly above that due to Adobe's strong execution and AI tailwind. However due to stiff competition and a very mature market I don't think we'll see a re-acceleration of growth to previous growth rates that the company has enjoyed over the previous 5-10 years.

B. Document Cloud

Document Cloud represents Adobe's fastest-growing segment.

This segment is centered around the dominant PDF format, Adobe Acrobat Reader makes working with PDFs much easier - e-signatures, editing and document management tools.

What's been driving this growth? The ongoing transformation from paper to digital formats. The same trends that's pushed docusign and similar companies to the fore are helping Adobe's PDF segment.

Adobe's Document Cloud benefits from two key advantages:

PDF Standard Creator: As the creator of the PDF standard, Adobe has a strong brand association with the format. This gives them a unique position in the market, akin to Microsoft's position with Office documents.

Technological edge: The company has been workin with PDFs since the format has been created and the Adobe suite of tools is the one that works best with them. Similar to other vertically integrated companies, there's a unique advantage to it.

Document Cloud serves several user segments, each with its own growth dynamics:

Enterprise: Large organizations implementing comprehensive document management solutions. This segment offers high-value, sticky contracts but comes with longer sales cycles.

SMBs: Smaller businesses adopting digital document workflows, often starting with e-signatures. This segment presents a large growth opportunity as more small businesses digitize their operations.

Individual Professionals: Lawyers, consultants, and other professionals requiring advanced PDF tools. This segment benefits from the growing freelance and gig economy.

The growth in all these segments is driven by the increasing need for digital document workflows, secure file sharing, and legally binding e-signatures. Adobe's AI-powered features, such as intelligent document parsing and automated form-filling, are becoming key differentiators in this space.

However, Document Cloud isn't without its challenges. In the e-signature space, Adobe faces stiff competition from DocuSign, which has become somewhat of a verb for digital signing. For basic PDF editing, Adobe competes with various free and low-cost alternatives. The challenge here is similar to what Creative Cloud faces with Canva – convincing users of the value of premium and AI features.

Where does AI play into the Document Cloud story? Much like with Creative Cloud, AI presents significant opportunities. Adobe's Sensei AI is being leveraged to offer intelligent features like automated form field recognition, document summarization, and even natural language querying of PDF contents. These AI-powered features not only add value for existing users but also help justify premium pricing in a market with many free alternatives.

Looking ahead, several factors could influence Document Cloud's growth:

Regulatory Tailwinds: Increasing regulations around document security and compliance could drive adoption of advanced features, benefiting Adobe's enterprise-grade solutions.

International Expansion: There's significant room for growth in emerging markets as they accelerate their digital transformation journeys.

Cross-Selling Opportunities: Adobe has a vast Creative Cloud user base to which it can market Document Cloud solutions, potentially driving growth through bundling and upselling.

AI-Driven Innovation: Continued investment in AI could lead to new features and use cases, expanding the total addressable market for document management solutions.

While not immune to economic downturns, Document Cloud may prove more resilient than Creative Cloud. Unlike design tools, document management is often seen as an essential business process. In fact, cost-saving initiatives during economic tightening could actually drive adoption of digital document solutions as businesses look to improve efficiency.

This business segment has also seen significant growth and has actually accelerated growth throughout 2024 - a very impressive feat. This shows that Adobe's go to market initiatives and dominant position in the market is proving powerful.

Pulling the threads together for Adobe's Document Cloud segment, I believe we can expect continued strong growth, outpacing Creative Cloud in the medium term. The combination of market tailwinds, Adobe's strong brand in the PDF space, and the potential for AI-driven innovation paints a promising picture. However, competitive pressures and the plethora of new AI tools will be ongoing challenges.

In the broader context of Adobe's business, the strong performance of Document Cloud could help balance any maturation in the Creative Cloud segment, providing a new engine for growth as the company evolves. The key for Adobe will be to maintain its innovation pace, effectively cross-sell across its product suite, and successfully communicate the value of its premium features in an increasingly competitive market.

C. Digital Experience

The less thought about business line for Adobe is its Digital Experience (DX) business. This is essentially a suite of enterprise-grade software solutions designed to help businesses manage, deliver, personalize, and optimize customer experiences across all digital channels. Think of it as a powerful toolkit for marketers, e-commerce managers, and data analysts to understand and engage their customers in a data-driven and highly personalized way. Facebook offers these kinds of tools when you advertise on Facebook or Meta properties, but if a campaign manager wants to create something similar across the web, it's very hard to do. Adobe acquired Marketo in 2018 and this provided the basis for this business line.

The DX segment represents the smallest portion of Adobe's revenue and is a slower grower. However it's market position is quite good as the competition in its space is less than other Adobe segments.

Growth Drivers

Businesses are increasingly focusing on digital marketing and customer experiences. This shift benefits Adobe's DX as they are a primary partner in this transformation. Growing demand for personalized marketing is a driver for DX as Adobe is vertically integrated - their tools are used from designing the creative assets through tracking the click through rate on the web.

AI and Firefly in partciluar has the ability to empower this greatly. As digital advertising increases with the adoption of AI tools and avoids disintermediation by platforms like Facebook, brand managers and marketing managers will increasingly need to use tools like Adobe Firefly to create personalized experiences.

By being vertically integrated, DX as a platform can win: Firefly can help create assets, distribute them through the DX platform, and automatically enhance and double down on successful assets. This approach enables more personalized and effective digital campaigns, leveraging AI-driven tools to optimize marketing efforts. This is a powerful growth story for DX.

Headwinds

Despite these growth drivers, Adobe faces several notable challenges. The marketing technology industry is fiercely competitive, with giants like Salesforce and Oracle offering formidable alternatives that directly compete with Adobe’s solutions, not to mention Meta and Google.

This level of competition raises questions about Adobe’s ability to maintain its market share over the long term. Another obstacle lies in the integration complexity of Adobe’s platform. While its comprehensive nature is a major selling point, it can also be a double-edged sword. Clients often face long sales cycles and implementation challenges as they work to integrate the platform into their existing systems. Lastly, there is ongoing debate about whether Adobe’s technological foundation is the best in the market. As the industry continues to evolve rapidly, some competitors are perceived to have an edge in specific niches, posing a potential risk to Adobe’s growth trajectory.

We should see the winner of this debate shake out over the next two years.

The puts and takes of Adobe's future growth

Adobe's growth story presents a complex mix. While all three segments are growing, Creative Cloud, the largest segment by far is suffering from declining rates and is being challenged on the low end of customer growth by new competition. Digital Experience seems to be a slow but steady growth aspect with a high degree of stickiness but also a high degree of uncertainty regarding future disruption due to AI.

Artificial Intelligence is a driver for Adobe's future growth narrative, even though that's not priced in to the stock yet. I have no doubt they'll be able to take price based on the value they're delivering with Firefly and other AI tools. However, AI is a double edged sword- while they'll be able to take price hikes in their higher end enterprise accounts, AI is helping smaller companies like Figma and Canva compete on the lower end, which limits

Putting it all together Adobe's 2025 guidance makes sense. Whereas in the past they guided to low double digit growth, for 2025 the company guided to 9% revenue growth. WhI think it's reasonable to expect a 8-10% growth rate going forward. Enterprise pricing will continue to be a growth driver, whereas the lower end will continue to be pressured.

The question regarding Adobe's revenue growth is how durable is it?

II. Moats, Growth Durability, and Market Position

Looking at Adobe's three main business lines, a clear pattern emerges. The company has built impressive moats through brand dominance, user lock-in and enterprise integration, but these advantages are facing new pressures from disruptors. AI isn't changing these themes, simply amplifying both.

Adobe's traditional playbook has worked beautifully across it's Digital Media segment (Creative and Document Cloud) - Brand dominance to get users, get users deeply embedded in their tools and workflows, then leverage that position for steady price increases. This strategy is most visible in Creative Cloud with professional designers, but you see the same pattern in Document Cloud with PDF workflows and Digital Experience with marketing stacks. Once you're in the Adobe ecosystem, switching costs are painful.

In the DX segment the moat is also around enterprise integration into core workflows, but the brand dominance is far less. Adobe isn't synonymous with marketing.

But even before AI the lower end of Creative Cloud was coming under pressure from companies like Canva and Figma.

Figma and Canva perfectly illustrate disruption theory in action. Both targeted segments Adobe ignored - Figma with collaborative design and Canva with simple templates for non-designers. Adobe underserved these segments due to its legacy business and pro users. But both companies kept moving upmarket, adding sophistication while maintaining their edge in simplicity and collaboration. Figma's collaborative features became so crucial that Adobe tried acquiring them for $20 billion, while Canva evolved from basic templates to a capable design platform for small businesses. It's classic Clayton Christensen - start with "good enough" products for underserved markets, then move upmarket. Adobe's response followed the typical incumbent playbook: ignore, dismiss, then scramble to catch up, all while facing the innovator's dilemma of defending against simpler alternatives without undermining their premium offerings.

AI is enhancing and contributing to all of these existing business dynamics. In Creative Cloud, AI features like Firefly are powerful but also make it easier for competitors to close the technical gap. In Document Cloud, AI is opening new opportunities in document intelligence, but it's also simplifying traditionally complex tasks that Adobe used to dominate. Digital Experience might actually benefit the most from AI, particularly in personalization, but they're up against the most serious form of disruption if the traditional marketing playbook becomes upended.

Because of Adobe's deep integration into enterprise workflows, their revenue is very sticky. AI doesn't change that. But their revenue growth is a large question. Pricing is a good avenue of growth, and I expect that to continue, but the new user growth could be very pressured and be a headwind to growth.

III. Valuation and financials

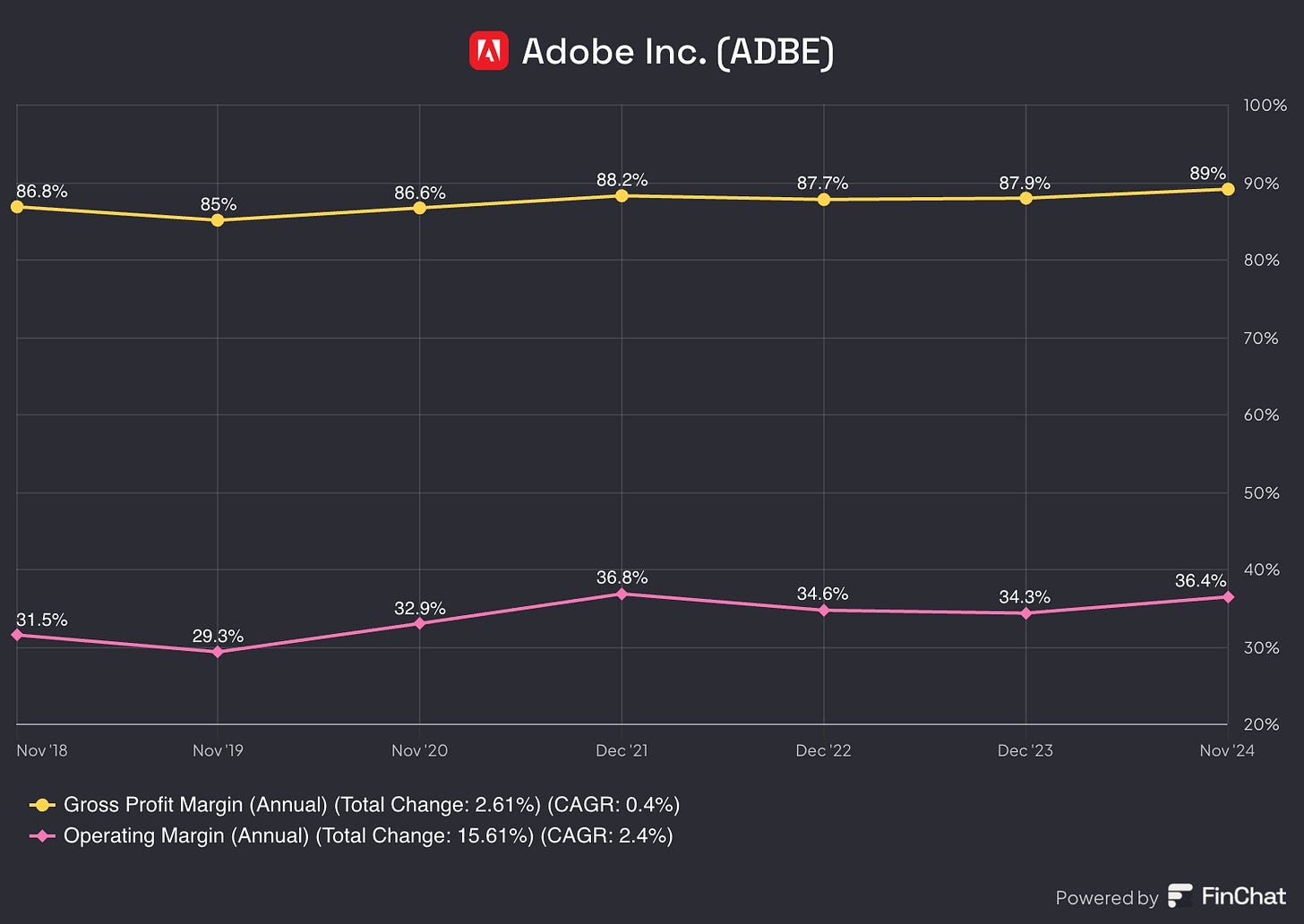

Adobe's financial metrics tell a story of a company that has successfully transformed from a boxed software provider to a cloud-based subscription powerhouse. This is a company that's mature, established and quite optimized.

Adobe's financial engine is seriously impressive when you dig into the numbers. The 88% gross margins are very impressive. They've been maintaining these margins for a decade, which speaks to their pricing power, stickiness and business dynamics. Gross margins have reached maturity. There's no real room for improvement.

The cash flow story is solid too, though it's also showing some signs of maturity. 40% FCF margins over five years is fantastic. But growth here has slowed to about 6% annually. This cash generation gives Adobe plenty of dry powder for whatever they need, whether it's M&A (like their $20 billion attempted deal to buy Figma), buybacks (their current $25 billion buyback), or investing in AI.

The operating margin trajectory might be the most telling metric here. Going from 10% to 36% over a decade is no small feat. What this really shows is that Adobe has figured out how to scale and build their SaaS business. They've become lot more efficient as they get bigger, which is exactly what you want to see in a software business.

Putting it all together, these numbers paint a picture of a company with incredible pricing power and efficiency, but one that's well into its mature stage - meaning future improvement in margins, FCF and bottom line metrics are all completely dependent on top line revenue growth.

This means that valuing the company is even more dependent on future revenue growth - something we've seen is coming down to a high single digit rate. Which leaves us the question - what's the right price to pay for this business?

Valuation

Here are different valuation metrics for Adobe, based on its stock price of $435:

2025 P/E: 21.3 (PEG > 2)

2025 P/FCF: 20.5

Inverse DCF implies that to justify its current price Adobe needs to grow 10.5% a year, each year for 10 years going forward.

All of these metrics highlight a rich valuation. For every dollar of free cash you need to put in $20.5 - as in it will take 20 years to get that money back, assuming no growth. With growth you'll recoup your investment faster, but still, we're talking about a long amount of time.

This is why the future growth rate of the company is so important. If growth slows to 7%, it would still take ~13 years to start earning a return on your invested capital. Growth rates matter when paying a 20x multiple.

The bottom line

Adobe is richly valued. To be fair, it's been richly valued for years and years. However, revenue has been decelerating and there's no clear sign as to why it would reaccelerate. Since the company is already running so efficiently, that revenue is the only driver for improved bottom line earnings and FCF per share.

This doesn't seem like a 'no brainer' investment opportunity. While I'm fairly certain the company is sandbagging guidance somewhat, it still doesn't seem like a 'bet the farm' type of approach.

Yes, Adobe's dropped 32% over the past 12 months, but perhaps that wasn't the market overreacting. Rather it was the market repricing in slower growth for a premium priced company.

What I’m doing with Adobe

In my own portfolio I owned Adobe for most of 2024 and sold out in November following the disappointing 2025 guidance. If I was more of a trader, I’d be comfortable putting a long position at current prices of $430, since I believe management has underpromised for 2025 results and there is quite a meaningful buyback.

However for my personal portfolio of long duration higher growth companies Adobe doesn’t hit the threshold to justify a position. A reverse DCF with a discount rate of 10% puts the company at exactly fair value currently, assuming 10% revenue growth over the next 10 years. To me that sounds too high given the amount of uncertainty around other disruptor companies in Adobe’s space like Figma and Canva. If Adobe dropped 30% (towards $300 per share) that would change things and justify making Adobe a core position or at the very least a powerful trade. I’ll wait and be patient with this one and willing to pay the price of missing out.

First time coming across your substack. Really nice breakdown of the current situation!

A big thanks for this. Amazing depth. Fantastic analysis and reflections. Been looking closely at adobe. Really appreciated this post.