SaaS vs AI in 2026

SaaS has been dead in 2025, but is this the case going forward?

“SaaS is dead” has been a real trade in 2025. The drawdown started in 2024, but it accelerated as LLMs improved and investor attention and capital shifted toward an “AI Agents are going to eat the world” narratives. The tension is sharpest when you compare 2025 fundamentals vs. stock performance: companies can print respectable revenue and earnings growth and still see meaningful multiple compression.

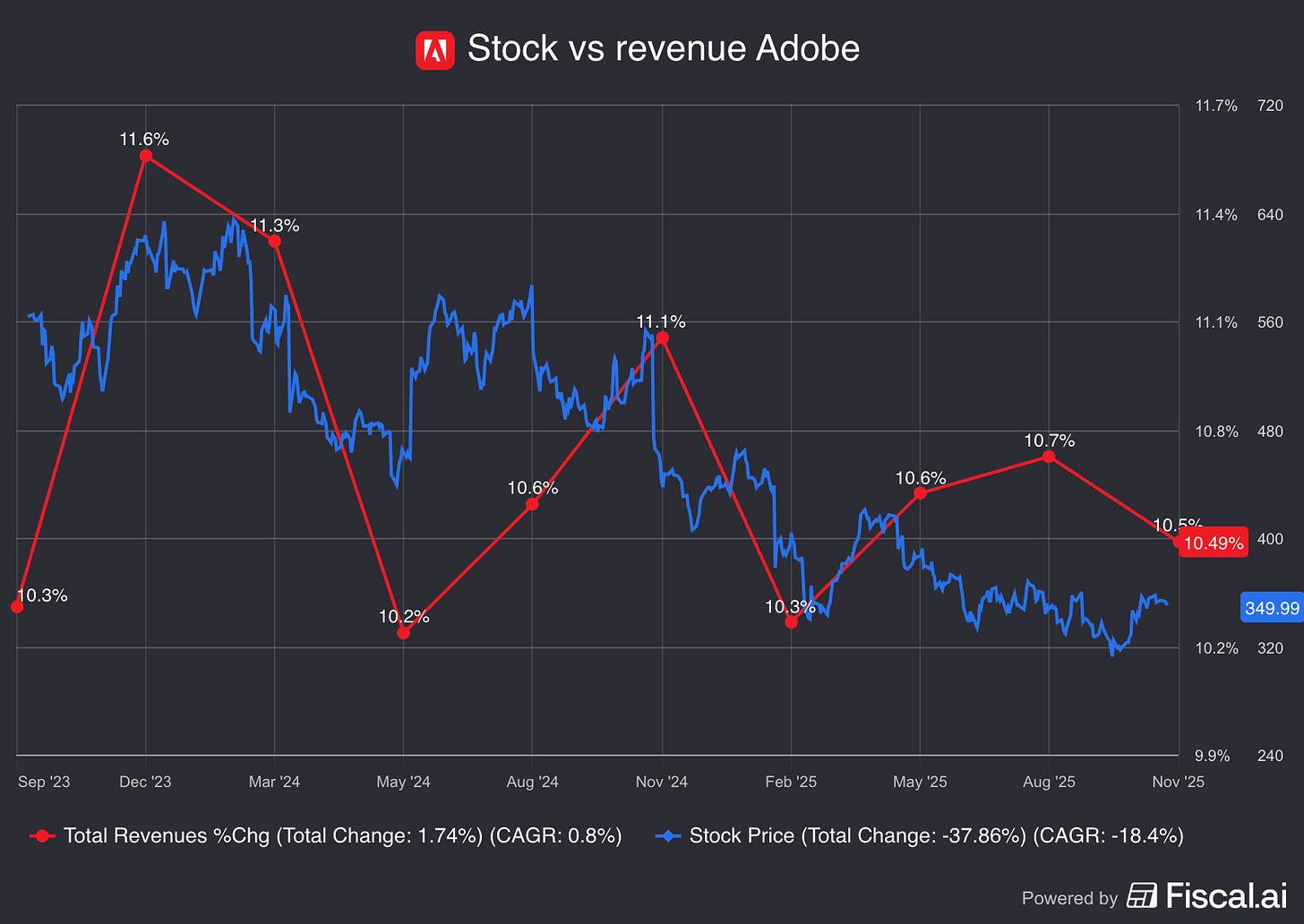

For example Adobe:

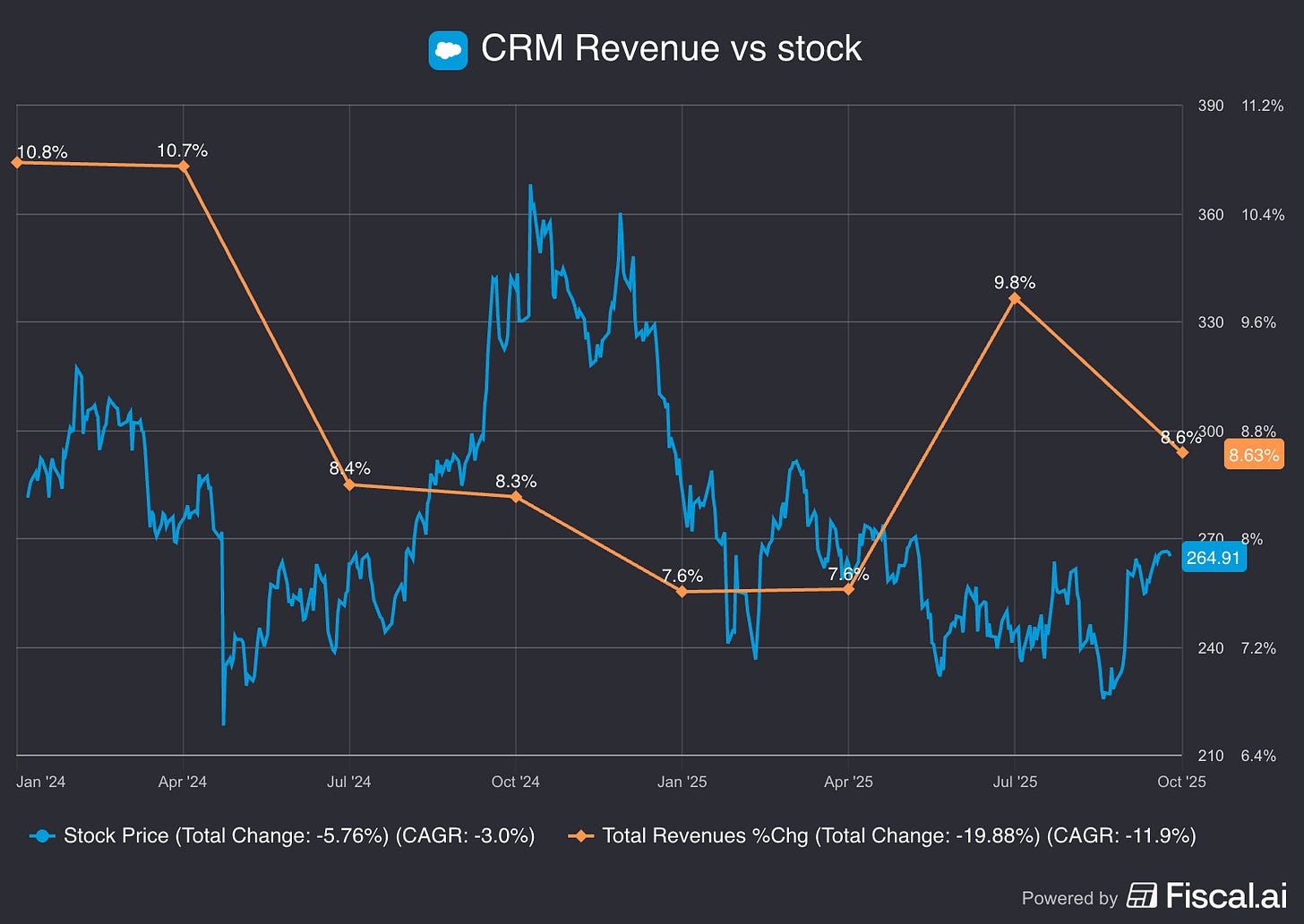

Salesforce suffered a similar fate:

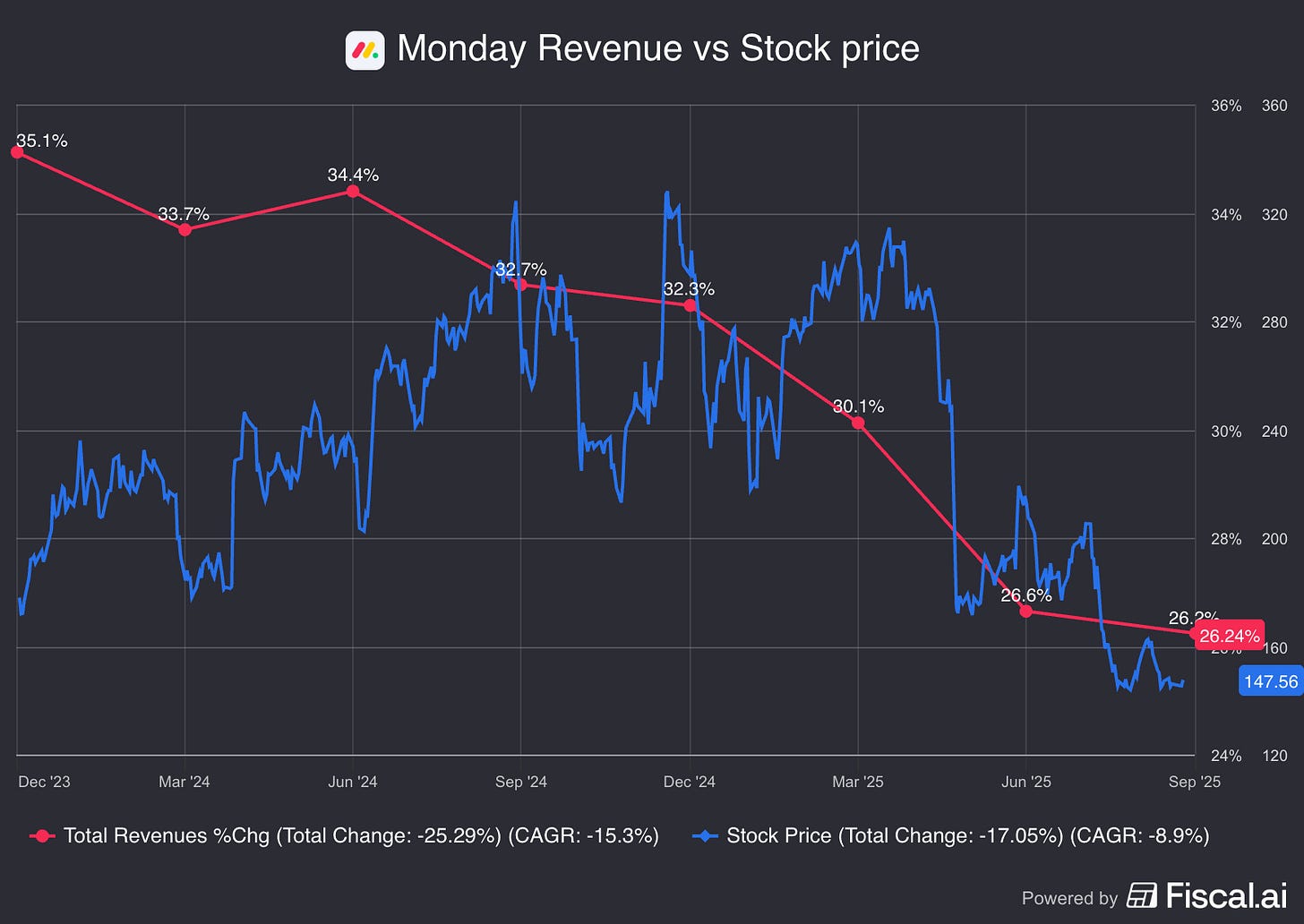

And Monday, which held up reasonably well all year round until it fell off a cliff in Q3:

To me, all three are examples of price action that implies two things:

Capital is being pulled into AI because the market expects it to be THE growth sector.

SaaS growth duration is being marked down. Even with current growth intact, multiples are shrinking, which means the market is pricing in either slower growth ahead or less durable growth.

The first point is hard to quantify. Sentiment analysis and macro market trends is beyond me and not a key part of my investment style. The second point is the one that matters most for my investment work: if AI structurally changes SaaS economics, the multiple compression isn’t a short term thing — it’s a forward-looking re-rating which needs to be taken into consideration. If this thesis is wrong, then this narrative is creating compelling investment opportunities.

So the practical question becomes: how does AI change the SaaS growth algorithm? To answer it, you need a framework that starts upstream, with where LLMs and agents are actually going, and then translates that into workflows, pricing, and competitive dynamics.

The bear case for SaaS, briefly.

Value capture shifts away from incumbent “systems of record” (SOR)

AI-native apps plug into the SOR/database and monetize the workflows, while the SOR becomes “just storage + compliance.”

Expansion revenue migrates to the agent/app layer that sits on top of the SOR, not to SOR-native modules.

SOR lock-in and differentiation erode

Agents make data more portable (extract/transform/migrate), weakening switching costs and “records” as a moat.

Reduced lock-in compresses pricing power and net revenue retention (NRR).

UI/UX becomes less important as agents become the interface

If work is done via chat/agents, traditional product surfaces matter less.

The “best workflow UI” advantage weakens; distribution and agent integration become the battleground.

Feature parity accelerates → commoditization

AI lowers the cost/time to replicate features, driving faster convergence across vendors.

Every deal/upsell becomes a multi-competitor knife fight, pushing CAC up and win rates down.

Seat-based monetization structurally declines

Agents do more work per human → fewer seats needed and/or slower seat expansion.

Legacy SaaS struggles to transition from seats/subscriptions to outcomes/usage

Packaging, entitlement, sales comp, and forecasting are built for seats.

Moving to outcome- or usage-based pricing risks revenue volatility and internal disruption (see next point).

Usage/outcome revenue is more cyclical and easier to optimize away

Customers can throttle usage, route around the product, or switch models/providers quickly.

Budget scrutiny hits variable spend first, increasing churn/downsells during slowdowns.

Gross margins deteriorate due to AI cost structure

Inference/compute and model-related costs raise COGS relative to classic SaaS.

Margin compression undermines the “SaaS model” valuation premium and reinvestment capacity.

Share of wallet shifts from SaaS line items to “AI spend”

Budgets reallocate toward LLM platforms, agent frameworks, and AI-native point solutions.

Incumbents may see slower growth even if total software spend grows.

Go-to-market friction increases

SEO and performance marketing are impacted as search intent shifts to AI native platforms where incumbents have less of an advantage.

Procurement scrutiny on SaaS rises due attention being sucked into the AI purchasing funnel and the new shiny thing.

Talent competition raises opex (especially SBC)

Scarce AI/ML talent increases compensation pressure faster than revenue ramps.

Execution risk rises if incumbents can’t attract/retain builders who can ship AI-native experiences.

Insourcing and low-end entry intensify competitive pressure

AI enables more internal tool-building (or cheaper white-labeled alternatives), especially at the low end.

New entrants can launch “good enough” versions quickly, compressing prices in simpler categories.

There’s a lot here in the bear case, but the TL:DR is: If AI lives up to its hype it can structurally pressure incumbent SaaS (whether SoR or workflow tools), which will put pressure on seat growth, the value chain and competitive position of these SaaS companies, shifting the value to the agentic experiences being built on top, therefore lower growth and revenue duration for the sector.

Put simply: seat growth slows and expansion cycles get tougher, even for healthy products.

Where AI is going (and what that implies for agents)

LLMs are improving, but they’re improving unevenly. The most important driver in the near term is not “general intelligence,” it’s reasoning + economics: better reasoning-style models become deployable at scale as cost per token declines. That combination is what has turned demos into products during 2025.

If you haven’t played around with the pro level reasoning models, you have to. They’re much much better than the free or ‘fast’ models. These thinking models are capable of reasoning at a high level, coding, and most importantly, doing work - AKA agents.

At the same time, even with the advancements of these models, there are persistent limitations that constrain what agents can reliably do inside real organizations:

Hallucinations / reliability (basic common sense failures, inability to learn from the same context window, let alone others and plain old hallucinations)

Domain expertise (LLMs are still generalists)

Connection to the real world (feedback loops and grounded training data)

Connection to the web / internal tools (real-time context)

Quality (what I’ll call intelligence)

My overall assumptions of the space are:

We’re not on the verge of “AGI - the singularity that replaces a huge percentage of human work. We’re still firmly in the human in the loop era, and will probably remain here for next 5 years.

Models will keep improving mainly through reasoning and efficiency (software + hardware gains). These improvements will be significant:

As hardware and software improvements decrease costs, models will be able to hold larger context windows, reason for longer and provide faster results overall.

Based on what experts are saying after Gemini 3, scaling laws seem intact and we can expect an increase in model quality around mid 2026.

However, these improvements still don’t solve everything.

Hallucinations and ‘quality’ are still significantly prevalent, i.e even 1% in a task that requires 100% is high.

Domain expertise in areas that are not publicly available information is a key factor in human labor and a limiting factor on LLM improvements.

Connection to the real time data, whether via the web or internal tools are still not there. MCP was a step forward, but many companies are still working on their ‘agent focused’ APIs. How much context do you need to provide? What kind of context? Where is that context even stored? What’s the actual record that the SoR needs to expose? How many API calls will external agents be able to make before being limited?

To me all this means that the near-term result is not “AI replaces everything,” but AI augments experts, handles more low-level work, and enables new labor that wasn’t economical before.

The main takeaway is that everyone is going to become an AI manager. You’ll need to delegate, evaluate, and manage tasks and agents.

This is where we must make our first AI impact distinction:

AI that increases efficiency: Cursor or ChatGPT increase the efficiency of existing employees.

AI that replaces workers: Agents who can code, review code and build complete new products or features replace workers.

The former is cool and impactful but not revolutionary. Both can impact seat growth and CIO spend, but only the latter can replace/commodify systems of record and existing SaaS. Agents that replace work are where the real value lies - if a company can save $10,000 a month on an employee, the amount they’re willing to pay is much higher than the standard per seat SaaS price. For companies that offer agents this means that if they sell enough agentic workflows, this can offset the slowing seat growth.

For example, if Salesforce can sell a sales agent which helps their customers slow down hiring from 5 BDRs to 1 BDR, they can price that sales agent much higher than their standard per seat price, since the value they’re offering is equal to 4 potential employees.

The agent reality for 2026: progress, but no clean leap

If reasoning improves and cost declines, agents are clearly the future, but with the limitations above. Agents are not constrained primarily by model IQ. They are constrained by access, integration, and accountability, and require a human in the loop for the near future.

This has practical implications for the value chain. These bottlenecks can shift the competitive landscape.

Why bottlenecks shift the competitive landscape

Being synced into data, work tools and work flow are a major constraint on the efficiency of agents. Sure, startups could plug into APIs and build from scratch, but incumbent SoR can have an intimacy with their data and workflows that a startup never could achieve. This is one the key points Aaron Levie makes at Box. Context, both in the org is critical as well as in the data and workflow. Box sits on mountains of unstructured data as well as an organizational structure of data. Put together that’s a lot of context on a company and a solid foundation for agents. Startups are completely reliant on building a new data structure of both context and structured data.

Once you accept that systems-of-record integration is the bottleneck, the competitive dynamic stops being abstract. For example, Monday is a work management tool that sits on both data and workflows. To implement an agent that calls dropped leads is technically easier, assuming they have this data and the architecture that enables them to access it and act on it.

Incumbent advantage

If there are no huge leaps forward in AI, then startups can’t “agent their way” around enterprise plumbing. Integrating into workflows that already exist, where data already lives is powerful.

That tends to favor incumbents that already sit on the system of record—because they control the objects, context, and governance layer that agents need to be useful.

The incumbent detractors

Incumbents don’t automatically win, because the above makes a few key assumptions: That they have the data, that the architecture is scalable and accessible and that companies can actually execute on this - both technically and business model wise (more on this below). Incumbents can be blocked by:

legacy architecture and data sprawl (hard to unify context and permissions),

security/compliance (agents executing actions creates audit and risk requirements),

organizational inertia (shipping an agent is cross-functional and slow),

business-model friction (moving from predictable seat ARR toward variable usage/outcome revenue can be strategically correct but operationally disruptive).

SaaS AI Evaluation Framework

With a solid foundation of the assumptions around AI, agents and the value chain in place, we can start getting to our SaaS vs AI analysis framework.

The pricing and monetization question that decides outcomes

In 2025 almost all SaaS companies were losers. But this won’t continue going forward. There will be SaaS winners, as well as losers. The winners won’t be the companies that “have implemented their own AI.” They’ll be the companies where LLMs don’t compete, but augment. Companies where AI tools replace seat growth, but the value provided commands premium pricing.

The below questions help spot these companies. The first two help you spot a company that’s being disrupted. Questions three through seven position the company on the AI value scale - how much will they be able to extract from their AI products vs lose out on seat growth.

How much does our core value overlap with LLMs?

How much does our AI offering overlap with LLMs? Are they just an AI wrapper?

Are we augmenting work, or replacing workers?

What is our pricing power versus the seat growth we lose?

If our product is cross-functional, what is the ratio of AI-driven uplift vs seat erosion?

Do we have a durable advantage (distribution, data, workflow control) versus new AI-native entrants?

Can we shift pricing and packaging toward usage/value without breaking procurement norms or investor expectations?

The more a company overlaps with LLM core competency, the more they’ll face competitive pressure.

The more a company augments work vs replaces it, the more pressure they’ll come under vs agentic solutions and the less pricing power they’ll have.

Without being able to replace work, pricing power decreases and the odds of being able to overcome seat growth deceleration decreases.

Example: Chegg

Chegg is a simple example. Their core value of personal tutoring overlapped completely with LLMs core value add. Their AI features were wrappers over ChatGPT. Without any real differentiation, ChatGPT, Grok and Gemini all ate their lunch.

By answering questions one and two honestly, you can see the disruption risk.

Example: Adobe

Adobe offers a more interesting and complicated test. I’ve written about Adobe a few times and one where the AI debate rages intensely.

Adobe has had a rough year, down 21%, despite growing revenue 10% and a monster ~$12B buyback.

What makes this even more stark is that Adobe was already down 24% in 2024, after, once again, growing revenue 11% and buying back billions worth of shares.

The market is clearly re-rating Adobe based on the AI risk described above: the duration and rate of growth going forward. Let’s run Adobe through the framework.

How much does Adobe’s core value overlap with LLMs?

Adobe’s core value isn’t text based, where a generic LLM shines. It’s the professional creation + editing workflow (Creative Cloud), PDF/document workflow (Document Cloud), and enterprise marketing stack (Digital Experience). Those are systems of tools, formats, and integrations.

Where overlap does exist is in specific tasks inside those workflows: ideation of images, generating images, generating low quality or generic images, drafting variations, extracting data from PDF and working with PDFs. In other words, LLMs overlap with features or parts of the workflow, not with Adobe’s role as the primary toolchain and system-of-record for creative/document artifacts.

This overlap isn’t non material, especially in the low end of the market or in the pro-sumer segment. It’s also quite in the bullseye path of the improvements in LLMs - Nano Banana has let me edit photos in a way that I’d use to have to use an editing tool.

→ Adobe will suffer from increased competition on the low end of the market, limiting their traditional growth funnel.

Does Adobe augment work, or replacing workers?

Creative Cloud: Firefly and AI features mostly augment designers by speeding up ideation, iteration, and execution.

Document Cloud: AI features (summarization, parsing, form fill) mostly augment knowledge workers and operations—less headcount replacement, more “process compression.” To truly replace workers, Adobe would have to build agents that integrate deeply into the data in a company’s PDFs to deliver actionable work. I don’t see this on the roadmap.

Digital Experience: this is the most plausible area for labor replacement (campaign operations, segmentation, personalization, reporting), but enterprises move slower here and governance matters. This is also a smaller segment of Adobe’s business.

Net: Adobe is not an “AI replaces the worker” story in the clean SDR-agent sense. It’s “AI raises output per worker,” which can still pressure seat growth.

→ Adobe’s AI and core value offering increases work efficiency per employee, but doesn’t replace workers. This will impact their pricing power.

What is Adobe’s pricing power versus the seat growth it loses?

Adobe can likely take price where it delivers premium value (pro creatives, enterprise accounts), especially as AI increases perceived productivity. Pricing is constrained at the low end by Canva/Figma and by “good enough” AI-enabled alternatives.

The problem is in the balance - the increased efficiency due to AI slows seat growth. If a company hires 4 less designers but is willing to pay an extra $10/month for their existing 12 designers, Adobe is a net loser on revenue growth ($70 * 4 = $280, whereas $10 * 12 = $120). Adobe needs to be able to hike prices in the amount of their lost seat growth just to maintain their revenue growth.

→ Adobe’s pricing power vs seat growth slow down is problematic, implying a slow down in growth.

If Adobe is cross-functional, what’s the ratio of AI-driven uplift vs seat erosion?

The previous point becomes even more pronounced in Adobe’s Document Cloud segment, which is more cross functional. Whereas Creative Cloud and the Digital Experience segments are very specific in an organization (designers or marketers), Document Cloud services many different teams and the pricing power is even less. Whereas in a design department a company could justify paying 30% more per designer if this means you can slow down hiring designers, this logic doesn’t hold in a cross functional environment. Slowing down hiring in sales, customer support or development due to agents doesn’t mean that a company will be willing to pay more for Document Cloud.

→ Adobe’s generalist segment is more succeptible to seat growth revenue erosion than the Creative Cloud, specialist segments.

Does Adobe have a durable advantage versus AI-native entrants?

Adobe’s durable advantages are:

Distribution: entrenched across professional creative and enterprise environments.

Workflow control / switching costs: file formats, learned workflows, integrations, asset libraries, and organizational habits.

Brand association: especially in Creative Cloud.

The exposed flank is also clear:

Low-end onboarding and collaboration is where Canva and Figma gained traction. Now LLMs are eating that onboarding lunch with Nano Banana, VEO3 and GPT 4 bringing image creation virality that Adobe has never experienced.

AI can lower the bar for competitors to reach “good enough,” meaning Adobe’s moat is durable, but not equally durable across all segments.

→ So Adobe is advantaged versus AI-native entrants in the “system-of-record + pro workflow” layers, but not immune in the simpler/collaborative/low-end layers. What this means to me is that switching costs remain high but net new customer acquisition cost is also increasing.

Can Adobe shift pricing and packaging toward usage/value without breaking procurement norms or investor expectations?

Adobe has shown openness to this over the past 18 months and has tested a few new pricing points and models, whether a credit based system or a premium subscription that offers more AI based features.

→ Adobe can raise prices since this is arguably part of their existing model already.

Adobe’s seat-growth vs pricing-power question (the real debate)

Putting this all together it seems clear that while Adobe has pricing power in their enterprise segments, this pricing power shouldn’t be able to offset the slowing seat growth the market is expecting due to AI driven efficiencies. This means that net-net Adobe’s growth rate will decline.

Additionally, LLMs offer a competitive risk for Adobe’s low end and Document Cloud segments.

→ AI won’t disrupt Adobe but it will pressure growth rates and growth duration, meaning that multiple compression is warranted.

One important caveat to this entire analysis...

Seat growth is declining in 2025, because:

CIOs are focused on AI spend

Companies are focusing on implementing and using AI properly before they hire

Both of these trends are temporary. In two or three years companies will reset the baseline for using AI as employees are trained and protocols are put into place. CIOs will be tired of AI spend and will once again look to spend in other, neglected categories. There is an inevitable competitive pressure in this market: once companies have utilized their efficiency gains via AI, and their competitors have as well, they’ll need to start growing their ‘humans in the loop’ once more. The work these humans might be doing will be different, but they’ll still need their relevant SaaS licenses.

Exactly - debate for Adobe is seats growth vs pricing rise. I am confident for this company, switching cost are high. Additionaly, They just bought semrush.